Quantitative Easing in the euro-zone is probably on the way. How much of it is already priced in? Did the markets get ahead of themselves?

The analysts at Bank of America Merrill Lynch weigh in:

Here is their view, courtesy of eFXnews:

By the end of 2014, the ECB provided strong signals that sovereign QE would start in early 2015. EUR/USD ended the year 13 percent weaker. As the new year begins, the key question is not whether the ECB will announce QE in Q1, but how far QE will go. Our economists expect QE to be large enough to make it worthy Our rates strategists argue that the market has not fully priced large scale QE yet. However, the market is already short Euro, with the CFTC data suggesting the most stretched short position since the peak of the Eurozone crisis. Our view is that the extent to which the ECB will surprise depends on the extent to which the market will perceive QE as openended. The market is already pricing diverging FED and ECB monetary policies. For the Euro to weaken further, such a divergence will have to take place faster.

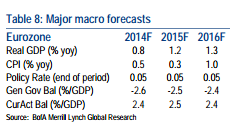

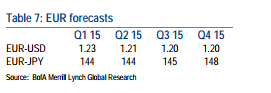

Forecasts: already at our year-end projection. Our EUR/USD forecasts of 1.20 by Q3 is at risk, as the cross is already at that level. However, we refrain from changing our projections before the January ECB meeting, as we are concerned that the FX market may have run ahead of itself. We also expect the strong USD and falling inflation expectations to keep the Fed cautious during its hiking cycle. We remain bearish EUR/USD in the long term, expecting it to weaken to 1.15 by the end of 2016.

Risks: ECB disappoints or overwhelms; US booms. If the ECB does not deliver large-scale QE (does not increase its balance sheet target), markets could be disappointed. On the other hand, open-ended QE will be a positive surprise. US data has been surprising strongly to the upside recently and could lead to a more upbeat Fed tone, supporting the USD further.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.