After all the falls in EUR/USD, is there still time for a short? All those 2015 predictions are getting closer as 2014 draws to an end.

The team at BNPP sees the descent to 1.15 starting soon, explains and provides a chart:

Here is their view, courtesy of eFXnews:

Policymakers will continue to dominate the foreign exchange markets in a busy H1 2015, says BNP Paribas.

“Monetary policy divergence trades remain our favoured strategies and the rhetoric has reinforced this as 2014 draws to a close. We expect downside in EURUSD and EURGBP, while USDJPY should rise, and we think the best performing trades will position for this,” BNPP projects.

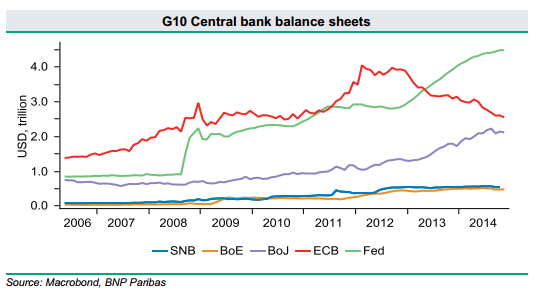

Specifically for EUR/USD, BNPP still sees the start of quantitative easing by the European Central Bank (ECB) in 2015 which will start to close the balance sheet gap with the Federal Reserve.

Meanwhile, BNPP thinks the USD will lead the G10 FX Pack in 2015.

“The USD will continue to find yield support: the spread between the two-year US Treasury yield and comparable German and Japanese bonds has reached new multi-year extremes…Anticipation of Fed policy tightening by Q3 of next year should continue to keep US front-end yields increasingly supported and yields are likely to become progressively “unglued” at shorter maturities as lift-off approaches,” BNPP argues.

“Given this, we think the EURUSD will begin its descent to 1.15,” BNPP projects.

In line with this view, BNPP maintains a short EUR/USD position in its portfolio going into 2015. The trade entered at 1.2520 with a stop at 1.28 and a target at 1.18.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.