When everybody says the same thing, there is room for suspicion. If everybody is long the dollar, who’s left to buy?

Well, in some cases, there are good reasons for the consensus. In the case of the US dollar for 2015, the team at SocGen asks these questions and explains why this bullish USD view could be right, and what conditions are essential for this to happen:

Here is their view, courtesy of eFXnews:

The biggest source of concern for dollar bulls is that the view is so consensual,notes SocGen.

“The Fed has stopped buying government debt and is preparing markets for a rate-hiking cycle. The ECB has ambitious targets to increase the size of its balance sheet, the BOJ is embarked on even more aggressive monetary easing, and even the PBoC is easing policy…No wonder the consensus is bullish,” SocGen adds.

The question then, according to SocGen, is: what can go wrong as well as how far could or should the dollar appreciate?

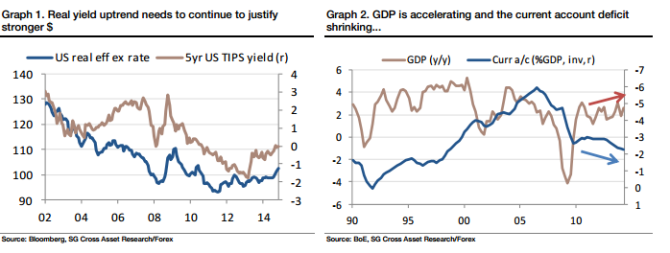

“The obvious risk is that the Fed does not raise rates in 2015 – either because inflation surprises on the downside or because the forecast acceleration in growth peters out yet again,” SocGen warns.

All in all, SocGen thinks that the consensus bullish USD view will likely prove right in 2015 on the following conditions.

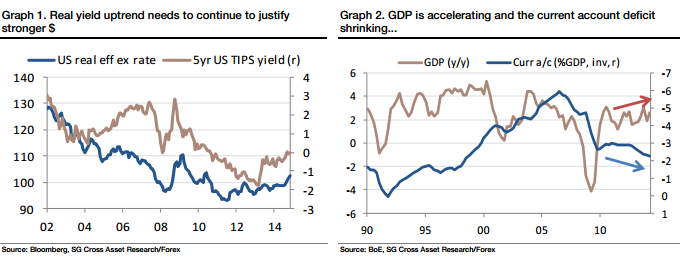

“The dollar will rally in 2015 as long as the Fed delivers at least one 25bp rate hike. It can rally by as much as 10% from here in trade-weighted terms if the Fed raises rates at least twice. And it can rally further than that if raising rates by 50bp causes a significant correction in global asset markets. In broad terms, a 5% dollar rally would be consistent with ongoing easing elsewhere, and 5-year TIPS yields rising to, say, 0.5-1,” SocGen argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.