EUR/USD is stuck in a well defined range. While this is a nice setup for some trades, many others would prefer to see a break out.

To what direction? The team at Danske sees a consolidation before the next leg lower and they explain:

Here is their view, courtesy of eFXnews:

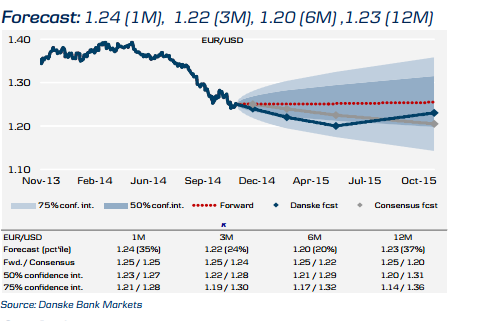

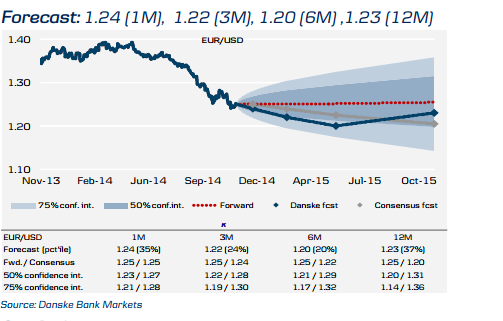

We expect EUR/USD to grind lower on monetary and growth divergence. We expect the ECB to reach for more tools in early 2015, paving the way for further EUR weakness.

Meanwhile, we expect the Fed to surprise markets and begin its tightening cycle in June 2015. We expect the USD to rally ahead of the Fed’s tightening cycle.

We expect EUR/USD to rebound on a six- to 12- month horizon as eurozone deflation risks disappear and the growth differential between the US and eurozone narrows.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.