What are the prospects for currencies looking forward to the new year? The team at BNP Paribas provides bold forecasts for the dollar, especially against the euro and the Japanese yen.

Commodity currencies may enjoy a better fate. Here goes:

Here is their view, courtesy of eFXnews:

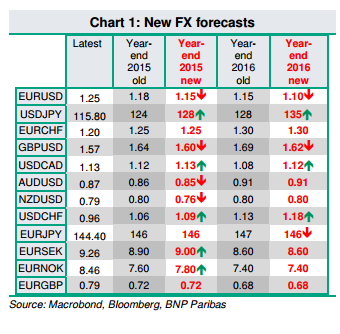

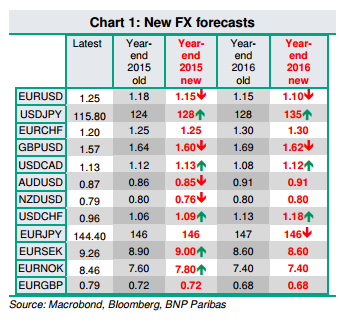

BNP Paribas revised today its FX forecasts to mainly reflect a stronger USD across the board going into 2015.

“The USD has considerable potential to appreciate further. We expect US growth of 2.9% in 2015, finally overtaking the UK to be the fastest growing G10 economy.Our central forecast is for a June Fed hike. Unemployment is falling faster than expected but weak inflation means the Fed is not rushed. We think the market is pricing in too late a first rate hike,” BNPP argues.

“The USD is tracking the widening of the short-end US yield advantage so increased hiking expectations should further support the USD. The US growth advantage has produced a mild recovery in net portfolio inflows driven by less outflows from US investors which should accelerate as growth expectations become more entrenched,” BNPP adds.

“Our monitor shows USD positioning has expanded but is not extreme. USD appreciation should be greatest versus the EUR, JPY and CHF,” BNPP projects.

In line with this view, BNPP now sees end-2015 forecasts for EUR/USD at 1.25 (from 1.18), for USD/JPY at 128 (from 124), and for USD/CHF at 1.09 (from 1.06).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.