Dollar/yen continues higher and is sitting above 116. What’s next for the fast moving pair? And what factors could move it?

The team at Citi discusses the elections and very high levels for USD/JPY:

Here is their view, courtesy of eFXnews:

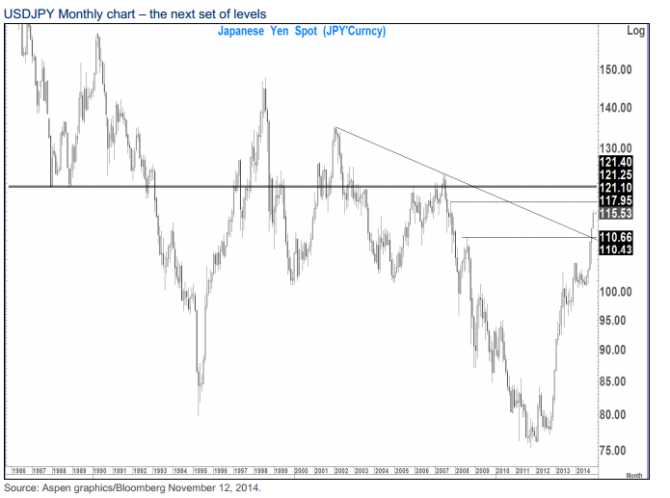

The previous setup and consolidation in the first half of this year looks similar to that seen throughout late 2012 and early 2013, notes CitiFX Technicals.

“In both cases we saw a consolidation in the form of a double bottom within a triangle followed by an aggressive bullish breakout,” Citi clarifies.

Thus, Citi thinks that if there is indeed a snap election – it would likely be on December 14th or 21st, almost exactly 2 years after the last one on 16th December 2012 – we could see the next set of levels in higher USD/JPY.

2 Scenarios For USD/JPY assuming a similar to the 2013 rally…

1– “The rally from the low in final quarter of 2012 and into 2013 saw a move of 26.6 figures over 36 weeks. If that were to repeat we could see 127.40 in 11 weeks (taking us to the end of January),” Citi argues.

2- “An alternative measure or projection would suggest something a little less aggressive. From the break level in December 2012 (at 84.18) we rallied 19.55 figures over 22 weeks. A repeat of that would put USDJPY at 125 in 12 weeks (end of January again),” Citi adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.