Both the Aussie and the kiwi have respected their trading ranges quite nicely. But is this here to stay?

Not exactly, argues JP Morgan. The team sees a clear direction for both currency pairs.

Here is their view, courtesy of eFXnews:

Despite the jump in volatility over the past few weeks, AUD/USD and NZDUSD have continued to trade within their well-defined ranges, notes JP Morgan.

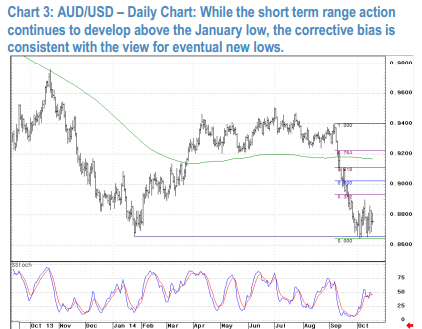

“For AUD/USD the reversal from the January low (.8658) has led to the current two-sided action. Similarly, NZD/USD has bounced after holding critical support at the .7722/.7683 area and lows from 2013 (June/September),” JPM adds.

“Despite holding these important levels, the overall downside risks remain intact,” JPM argues.

For AUD/USD, JPM thinks that the .8900/.8935 area should continue to act as important initial resistance and while intact, this retracement should maintain the sideways bias before the medium term downtrend resumes targeting the .8500 area before deeper targets near the .8315 low from July 2010.

For NZD/USD, JPM is closely monitoring for signs that the medium term trend is getting back on track where a violation of initial support levels near .7805/.7795 would suggest an increased risk that new lows targeting the .7455/.7335 zone.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.