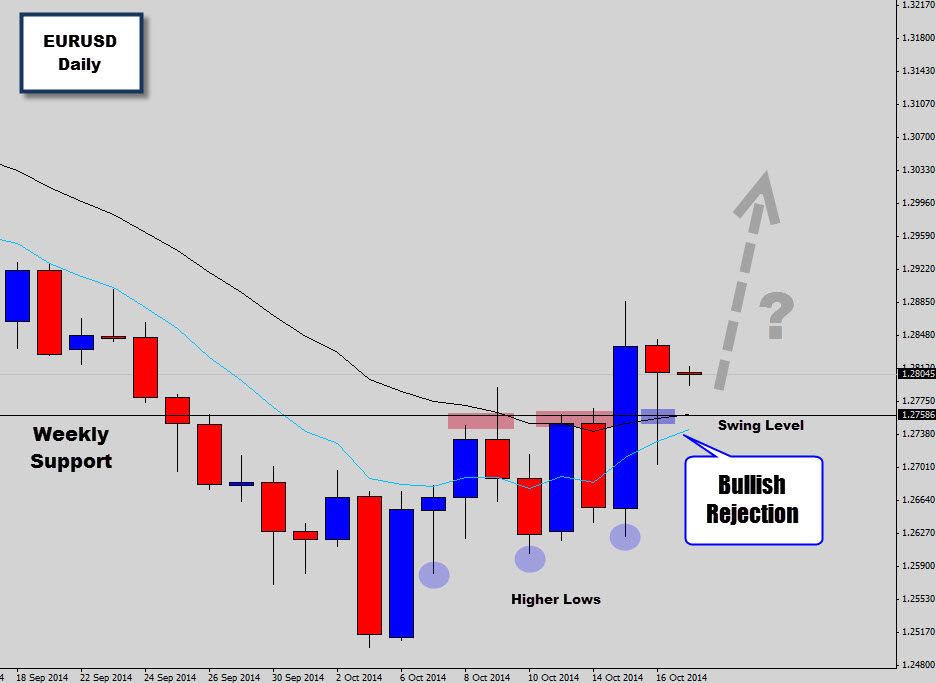

EURUSD has suffered quite heavy losses in the last few trading months – thanks to the strength gained in the USD. We all know that these trends don’t last forever and the markets can shift from bearish to bullish sentiments overnight. The EURUSD downtrend looks like as it has run out of steam as the market overshot a weekly support level (major turning point on the weekly chart), consolidated, then shot back over the weekly level. Drawing support and resistance levels from the weekly chart can be very helpful in spotting potential reversal points.

The daily chart has been printing higher highs and higher lows, the classic signs of a developing uptrend. This week we see a bullish power move punch back up through weekly support, then last session come down and re-test the level from the top side. Moves down lower into the weekly support were rejected by the bulls – creating a bullish rejection candle that we can work with.

If this bullish rejection candle takes off, we could see the push back into new highs and develop into a new bullish uptrend. Currently waiting for a retracement entry to be triggered to tighten up the stop loss spread here.