The US dollar seems to be second in the list of safe haven currencies, after the Japanese yen, and it is certainly not as strong as it used to be earlier in the month.

Is it still overbought? The analysts at Credit Agricole certainly think so, and they are probably happy with the position they took on EUR/USD:

Here is their view, courtesy of eFXnews:

The USD is broadly firmer as risk sentiment remains subdued and weakness in European data persists. EUR ticked below 1.2650 again while GBP traded below 1.60 for the first time in over a week.

However, the USD remains largely in consolidation mode with both the DXY and BBXY still about 1.2% off the early October highs. We expect the USD to chop around in recent ranges for now but look for further consolidation and position clearing before the broad rally can resume.

The next big event is the October 29 FOMC meeting and the market is starting to look for dovish signals from the statement given sharp drop in US inflation expectations and the slowdown in Europe and China. Indeed, while the divergence theme across the global economy is gaining steam (supportive of our long-term bullish USD view), we an intensifying global economic slowdown could delay the normalization of US monetary policy, especially if global tail risks continue to increase.

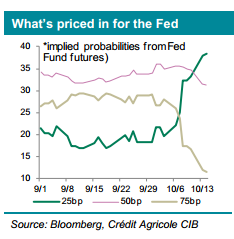

We note that the fed fund futures is pricing in a 50/50 chance of a 25bp rate hike in September 2015 compared to a 48% chance of 50bp worth of tightening at the September 2015 just a month ago.

Fed officials have recently voiced some concerns about weak inflation pressures, which we also think could remain a source of concern for the USD in the near-term, helping further consolidate recent gains.

*CA went long EUR/USD last Friday at 1.2660 with a target at 1.31 and a stop of 1.2350.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.