Editor’s note: We hereby bring the Q3 and beyond foreign exchange outlook written by FxPro Head of Research Simon Smith.

Executive Summary

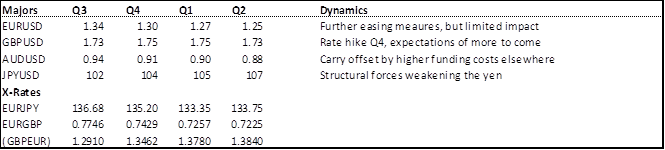

- We did not start the year as secular dollar bulls but were still over-taken by the disappointing dollar performance, largely (but not wholly) down to the weaker US economy in Q1.

- Central banks have helped to create the historically low levels of volatility that pervade FX and other markets and need to do their bit to bring a little more uncertainty as tightening gets nearer

- We were relatively correct in sterling and euro outlooks for H1, less so for yen and Aussie.

- Sterling should receive continued support from a likely Bank of England rate increase this year.

- The Aussie should remain relatively well supported in Q3, together with the euro.

- The yen is likely to weaken in the latter half of the year.

The Majors in 2014

The year so far

The disappointing dollar performance was not just about the weak economy… We were closest on the euro with our H1 forecasts

|

The subtitle to our 2014 dollar outlook ‘subtly stronger’. The first half of the year stretched the definition of subtle to the limit (dollar index up just 0.3% to 23rd June) and the dollar did not wholly perform in the way we envisaged, but we were correct in saying we were not heading for a “secular dollar bull market as the Fed starts tapering”.

The disappointing performance of the US economy was the key driver of the dollar early on, but underlying this was the fact that the relationship between quantitative easing dynamics (in this case the tapering of bond purchases) and the dollar was a lot weaker than was the case in the early days of the financial crisis. As such, we found the “tapering = firmer dollar” mantra as flawed in its approach. On the majors, our biggest miss was the Aussie and yen (0.85 and 107 for end Q2) . Even though we recognised that the Aussie was far less correlated with China, the domestic economy and the shift in stance from the RBA were the key drivers to the strength, together with the generalised search for yield as volatility was crushed to multi-year lows across most asset classes. As for the yen, we were added to the pile of other forecasters who have tried and failed to fully rationalise the Japanese currency. We were closest on the euro, although not quite achieving our end Q1 target of 1.41 (end Q2 1.38). Back in December, the market (Bloomberg survey of forecasts) was looking for EURUSD at 1.30 by mid-year, reflecting the view that further easing and deflation were set to weaken the single currency. The sterling strength we were envisaging for Q1 did happen and more rapidly than we anticipated. The surprise was the shift in interest expectations into the end of Q2, with Carney indicating a potential rate rise by the end of the year, a view which we took on board before his speech and continue to believe will come to fruition. The market was looking for cable at 1.60 by the end of Q2, so we were on-side (seeing 1.63) vs. the market, but some way off the reality (only 2 of 70 forecasters saw above 1.66). The other development, that did have implications for FX, was the collapse in volatility and also bond yields during the first half of 2014, especially in the eurozone periphery. The fall in volatility was caused in part by central bank policies, including forward guidance, together with the steady and assured pace of Fed tapering. |

The volatility conundrum

Central banks have played their part in crushing volatility in FX and other markets

|

As we head into the half year end, the lack of volatility in markets is one of the defining factors for pretty much all asset classes. For FX, we’ve seen declines in both intra-day ranges and by design implied volatility in the options market. At the same time, bonds have rallied, both in the US (on the back of the weaker economy) and also peripheral Europe. Italian yields were on a par with UK yields mid-June. Even short-dated German government paper is at a real risk of seeing negative yields once again (as happened in 2012 and the first half of 2013).

The reasons are plentiful, not least the lack of policy action from central banks, together with the reduced effectiveness of current policies that have been running (on and off) for several years now. Furthermore, forward guidance has meant that markets have placed a lot of faith in central banks and put little risk of them actually being incorrect in their ability to keep rates low for an extended period. The parallels with 2007-08 have already been made, but are pertinent. Back then, there was an over-reliance on the ability of central banks to deliver non-inflationary growth and the financial system to adequately price and diversify risk. The fact that the latter two assumptions proved to be incorrect, primarily in relation to sub-prime mortgages in the US, but also elsewhere (e.g. peripheral yields in Europe), was one of the primary catalysts of the global crisis that followed. This is not to say that we are heading for a similar scenario now, but the under-pricing of risk in general, and the stretched valuations on assets, should not be ignored. There are two potential catalysts to greater volatility. The first is that there is a rush for the exits, combined with lower liquidity, that arises from the current valuation of equities and other asset markets. The second is greater action, or potential action from central banks, together with less guidance from them on the likely future direction of policy. We are potentially seeing this shift in the UK (more on this below), which has already been felt on sterling, both in term of actual volatility and also options pricing, with premiums rising as a result. Before Carney spoke in June, suggesting that the market was under-estimating the chance of a rate hike this year, I was of the view that the Bank’s stance was becomingly increasingly flawed in trying to guide the market (see “Killing forward guidance” from May). |

Outlook for major currencies

|

The Dollar – Struggling

Sterling – self-assured

The euro – fighting deflation

The yen – better behaved

The Aussie – defiant |

As mentioned before, we were not great buyers of the secular dollar bull trend for 2014. That view still holds and has been enhanced by subsequent events, principally the weaker economy and stronger pound. We’ve talked a lot in recent years about the change in dynamics surrounding FX markets. The “risk-on, risk-off” mantra that went by the wayside two years ago now, the shorter trends on major currencies and also the reduced impact of quantitative easing measures (see for example “From RORO to MoRO”).

We still expect to see the dollar gain through the latter half of 2014, but the gains are likely to be modest. On average, we’ve seen the dollar index trade an absolute annual range of around 8% (peak to trough) in recent history. This year, the range has been less than 3%. We were looking for an increase in the dollar index of around 4% for the year as a whole (currently 0.5%) and this is now likely to be more like half of this, given our underlying forecasts. The Fed will continue with the current pace of tapering, but will keep their powder dry in relation to the tightening of policy. Another factor constraining the dollar this year has been the fall in bond yields. Asset market dynamics will continue to be a factor in the dollar’s fate. The debate as to where the greater valuation risks lie will continue, but both a fall in stocks and more so a bond market sell-off will have dollar positive implications. Many factors affect currency valuations, but interest rates, both actual (principally via carry) and expectations for future changes (e.g. via 2 year rates) are the one thing that invariably stand the test of time. Back at the end of 2013, the prevailing view was that the US would be putting up interest rates before the UK, thanks in a large part to the adoption of forward guidance by the Bank of England. Of course, time will tell, but currently the market expects the UK to move first, with pricing currently suggesting the first UK rate hike in Q1 2015. In reality, we expect it to come in November this year. Recall that the US was the first to fall, they cut rates earlier and faster than the UK and the economy hit the pre-cycle peak in output a full 3 years before the UK, which has only just achieved that. The main difference was the labour market, the UK holding up well (although productivity falling), the US suffering a damaging reversal from which it has still yet to fully recover from. Even if rates do rise, we are talking only a quarter of a point and a gradual tightening cycle thereafter. As such, the currency implications should not be over-played. For cable, we should see it capped by the 1.75 level for the remainder of the year. And let’s not get carried away in thinking that all is well with the UK economy. The external sector (current account as % of GDP) continues to deteriorate, not that far off levels last seen in the late 1980s. Furthermore, wage growth continues to be weak and only just keeping up with inflation. But growth is likely to touch near 3% this year, so a cautionary rate hike remains warranted. We went into 2014 relatively bullish on the euro. The interest rate angle to the single currency was a lot more complex than many were making out. It was not a case of a rate cut would automatically lead to a lower currency, as proved to be the case with the November 2013 easing. There were other forces at play, notably the repatriation of funds ahead of the ECB asset quality review, but also the strong performance of European asset markets in general, especially peripheral bond markets. More recently, the combination of measures announced by the ECB in June did serve to bring down short-term funding costs and naturally the euro has underperformed most major currencies both ahead of and after the event. For the second half of 2014 though, asset market performance will still be a dominant force. The policy measures announced by the ECB are not likely to have a major negative impact on the currency. Furthermore, the liquidity provision via TLTROs is not due to start until September. If peripheral markets continue be characterised by comparatively low yields, this would mean that we see modest, if any euro depreciation vs. the dollar in the third quarter. We don’t expect the ECB to undertake QE in the traditional sense of the word. It is likely that they will undertake some further programs in relation to asset backed securities as a means to attempt to lower borrowing costs, but there is no big bazooka. The eurozone’s deflation risk is largely structural, borne from the build-up from internal imbalances that cannot be cured by the usual means available outside a currency union. The yen fell into a relative slumber in the first half of 2014, USDJPY falling to trade in the 101-104 range for the most part. The momentum towards policy induced weakness waned together with the government’s inability to follow through on the much heralded structural reforms. The BoJ, having done its bit, stood back whilst the consumption tax hike took place and the structural reforms failed to materialise in any meaningful sense. The outlook for the second half of 2014 is still for a weaker currency, but only modestly so. There are three forces behind this. Firstly, the structural current account surplus that has meant Japan has been the largest creditor nation for the past two decades is moving into negative territory. There is not a strong causal relationship between this and a weaker currency, but it represents a change that will start to impact in the coming quarters and years. Secondly, there is the shift towards greater investment overseas from Japanese investors, something that has been much talked about, but has yet to happen in any meaningful way. That said, the pressures on Japanese savers to enhance returns is getting ever greater. Thirdly, there is a realisation on the part of the government that pushing ahead with structural reforms is the most likely path towards gaining further yen weakness, the BoJ’s ability to further weaken the currency becoming ever more curtailed. We’ve long been of the opinion that both carry and also commodity prices were becoming less key for the Aussie. These two factors had been defining factors in explaining the Aussie performance over recent years. Returns from carry trades have struggled for most of the post-crisis period as the Aussie had looked increasingly over-valued, but the carry offered was also slimmer. The changes in commodity dynamics have been evident for some time now. The old dynamic was that the Australian currency was just nothing more than a proxy for China. Exports of iron ore to China are still up over 40% over the past year (similar for coal), so it’s not as if Australia is seeing this dependency decline. But what is happening is that this is becoming less important in dictating the direction in the Australian dollar. This change in dynamic we have written about on several occasions, such as “Explaining Aussie Resilience”. The central bank went from actively trying to talk down the currency in December 2013, to taking a more neutral stance this year. They continue to observe that the exchange rate “remains high by historical standards” in their rate decision statements. This shift in stance cannot be ignored, so we take a more neutral to slightly softer view of the currency for the second half of 2014. It’s likely that the Aussie will depreciate, more in the fourth quarter, but this will be more modest compared to expectations at the beginning of the year. |

|

Simon SmithHead of Research

FxPro |

Disclaimer: This material is considered as a marketing communication and does not contain and should not be construed as containing investment advice or an investment recommendation, or, an offer of or solicitation for any transactions in financial instruments. Past performance does not guarantee or predict future performance. FxPro does not take into account your personal investment objectives or financial situation and makes no representation, and assumes no liability to the accuracy or completeness of the information provided, nor for any loss arising from any investment based on a recommendation, forecast or other information supplied from any employee of FxPro, third party, or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. This communication must not be reproduced or further distributed without prior permission of FxPro.

Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary.