NZD/USD is moving inside a strong uptrend, as seen on its long-term forex time frames. However, the pair is testing the top of the ascending trend channel on the daily chart, indicating a potential selloff.

Recall that the latest leg of the rally was inspired by a hawkish RBNZ (Reserve Bank of New Zealand) interest rate decision wherein policymakers agreed to hike interest rates. This led traders to buy the New Zealand dollar against most of its currency counterparts in order to take advantage of the positive carry and in expectations of more rate hikes.

Meanwhile, the US dollar has lost its appeal when the March non-farm payrolls figure came in weaker than expected and failed to trigger a drop in the jobless rate. This was followed by a downbeat FOMC meeting minutes release that showed dissent from policymakers when it comes to tightening monetary policy or hiking interest rates.

Export issues, particularly in the milk industry, have undermined Kiwi strength in the past couple of weeks though. This could cause the central bank to take a less upbeat stance in their next monetary policy statement during which they are likely to keep interest rates on hold for the meantime.

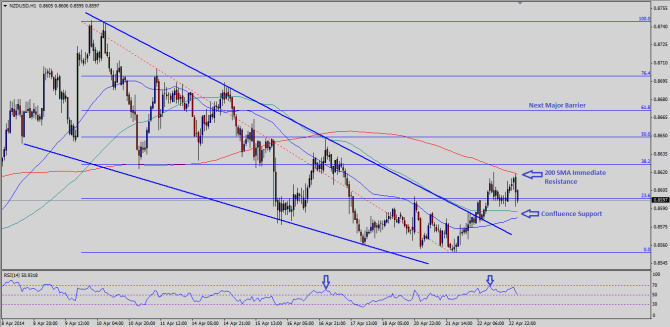

A selloff from the current levels, which could be sparked by a dovish RBNZ rhetoric, could last until the middle of the channel. As you can see from the chart, there is an area of interest somewhere between the .8200 to .8300 major psychological levels, as price has consolidated previously there.

On the other hand, an upside break spurred by a hawkish RBNZ rhetoric could lead to a test of the next resistance levels around the .8700 area. Take note though that the RBNZ is wary of further gains in the currency as this could wind up hurting their export industry again. An upbeat rate statement combined with currency jawboning could still lead to New Zealand dollar weakness or at least more consolidation.

There are no major reports lined up from the US economy so far, which suggests that the behavior of this pair could depend mostly on New Zealand events. Data from the economy has been strong so far, save for the recent downturn in dairy exports. Meanwhile, traders are anticipating more jobs weakness for the US economy in the April non-farm payrolls figure release next week.

For more, see the NZDUSD prediction