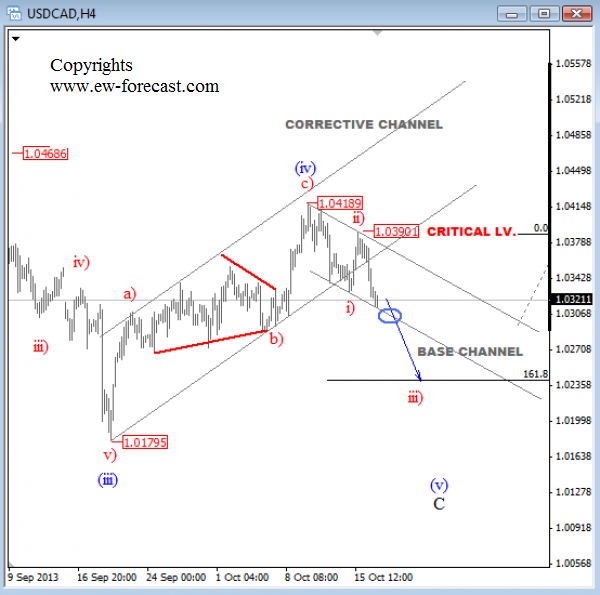

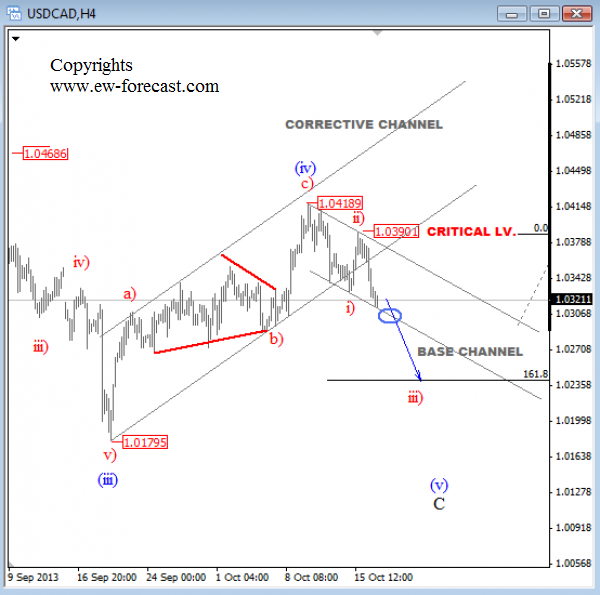

USDCAD is looking bearish after a turning point from 1.0418 where a three wave rally from 1.0180 was most likely completed with a corrective retracement labeled as (a)-(b)-(c).

Notice that the pair already took out the lower trendline of a corrective channel that usually leads to a continuation of a larger trend.

In our case, the larger trend since early September is down so we expect more weakness in the upcoming days and possibly a revisit of the 1.0180 level, probably next week.

Based on the latest price action from 1.0418 we see prices moving down in a third leg of decline which is ideally wave (iii) that will accelerate to a typical 161.8% Fibonacci target once the lower line of a base channel is taken out. The critical, short-term invalidation level is now at 1.0390.