Markets gapped on Sunday against the USD after the U.S. President Barack Obama delayed a military strike against Syria by requesting authorization from an incredulous Congress. From a technical perspective the wave patterns and direction did not change much.

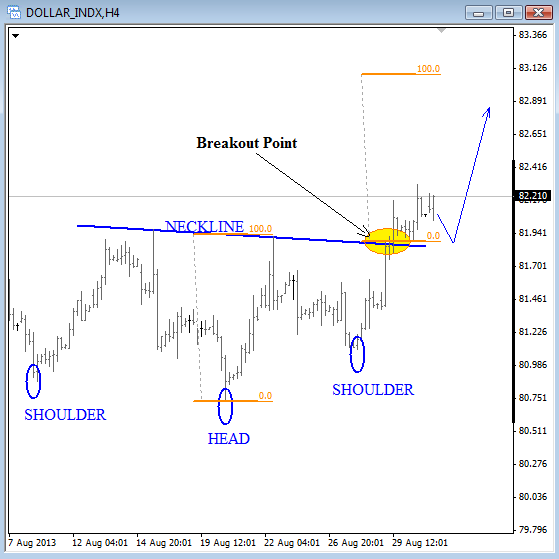

We are bullish on USD. This means we expect weakness on the majors, such as EUR, GBP, CHF, AUD and even JPY. The reason is the following Inverse Head and Shoulders pattern on the USD Index 4-hour chart which already appears complete after a push above the neckline at the end of the last week.

This break is pointing for a stronger USD, ideally towards 83.00 where we can see the Head and Shoulders projection measured from head to neckline and then from a breakout point.

USD Index 4h Inverse Head and Shoulders pattern

Moves following the completed Head and Shoulders pattern are usually very strong so while the market is moving higher we do not expect any larger corrective move, maybe only down to 81.80 where broken neckline (resistance) may turn to a support.

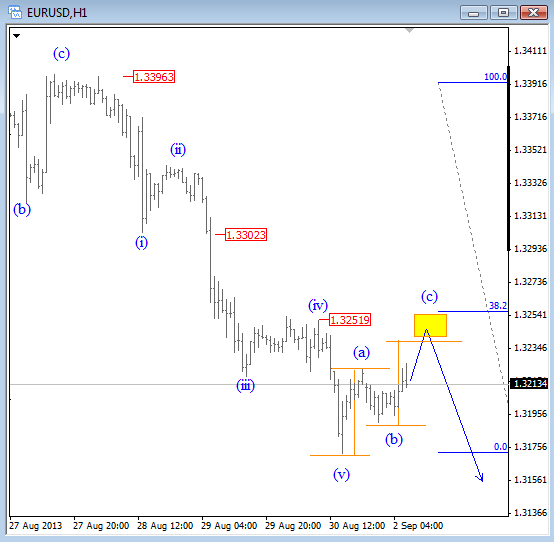

This will then be an ideal scenario for a downtrend continuation on the EURUSD which completed a five wave decline on Friday around 1.3170 but rally from there is only in three waves, so we assume it’s a zig-zag that will find resistance around 1.3250 zone, at former wave (iv).

EURUSD 1h