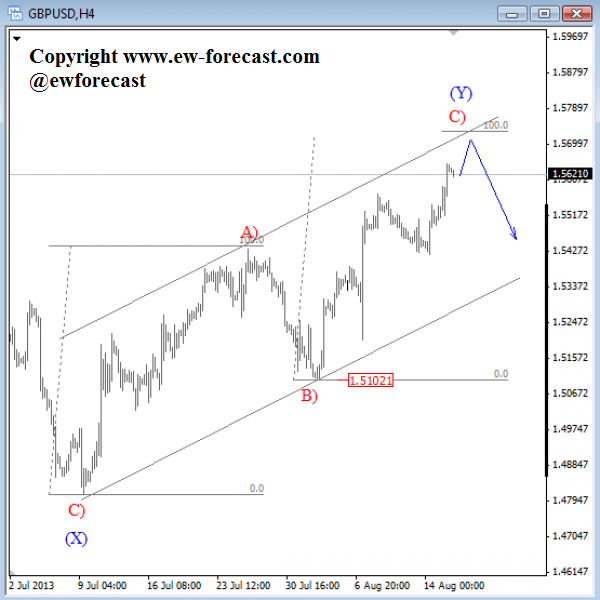

GBPUSD is moving higher, but the rally from July’s low is still in three legs with wave C) now near completion as the price is approaching the upper trend line of a corrective channel as well as an equality level compared to wave A).

We can also count five waves up from 1.5100 wave B) low, so sooner or later reversal will follow, ideally from 1.5700.

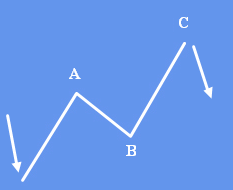

A three wave A-B-C move in Elliott Wave Theory is called a zig-zag that generally moves counter to the larger trend. It is one of the most common corrective Elliott Wave patterns.

• Structure is 5-3-5

• wave A must be a motive wave

• wave B can only be a corrective pattern

• wave B must be shorter than wave A by price distance

• wave C must be a motive wave.

• appears in wave two or four in an impulse, wave B in an A-B-C, wave X in a double or triple zig-zag, or wave Y in a triple threes