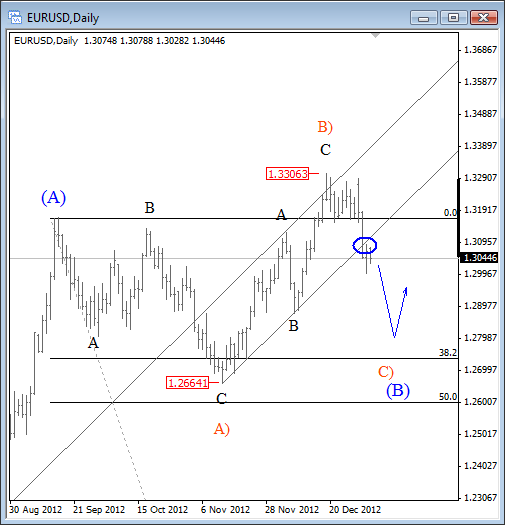

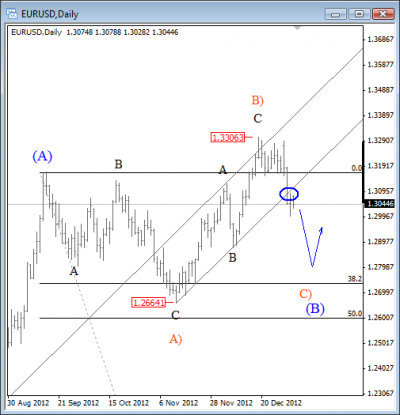

EURUSD made a deep and unexpected pull-back last week, falling slightly below trend-line connected from 1.2660 that indicates that temporary highs could be in place. As such, we would not be surprised to see even lower levels in the next few days or even weeks.

However, keep in mind that this decline is still part of a larger corrective wave (B) that is part of incomplete bullish three wave rise from 2011 lows. The reason for this is a three wave rise from 1.2660 which is a corrective movement, (labeled as wave B) on our chart. There are only two patterns now that EURUSD could form; flat or triangle.

Support for the pair is at 1.2870 and 1.2660.

For more detailed elliott wave analysis regarding the dirrection of EUR and USD in 2013, please check video below.

Test our services now absolutely free: “7-day trial”

Click here