The British government confirmed that it would trigger Article 50 on March 29th, 2017. This starts the 2-year clock ticking backward toward the exit. According to the famous clause of the Lisbon treaty, an extension to this period can only be made if all the remaining 27 members agree.

Prime Minister Theresa May had already pre-announced the action back in October. She circled “by the end of March.” Some legal hurdles and a back-and-forth between the House of Commons and the House of Lords were all dealt with on time, and the government is set to meet its self-imposed deadline.

The hard part and a hard Brexit

And now, tough negotiations can commence. Reports coming out of Brussels noted that deliberations could start only in June. While a deal is in the interest of both sides, perhaps this postponement is part of a tough stance, showing other members that heading for the exits has its price.

A transitional deal for about five years is certainly an option. This would allow getting into all the details of post-EU membership trade and immigration arrangements and would also allow for a new parliament to decide what Brexit means.

The EU Referendum on June 23rd, 2016 resulted in a clear vote for Brexit, but the exact ramifications on a wide variety of issues are far from clear. May said that “Brexit means Brexit.” She vowed to respect the will of the people, as shown by a 52% to 48% majority to leave. But what does it mean for trade and immigration? And EU nationals residing in the UK or Brits living in Spain, France and elsewhere?

Various public appearances by the Prime Minister have leaned towards a “Hard Brexit” or a “Clean Brexit” as she would prefer it to be known. Similar to the EU’s leg-dragging move, her stance could only be the initial posture for the talks rather than the desired outcome.

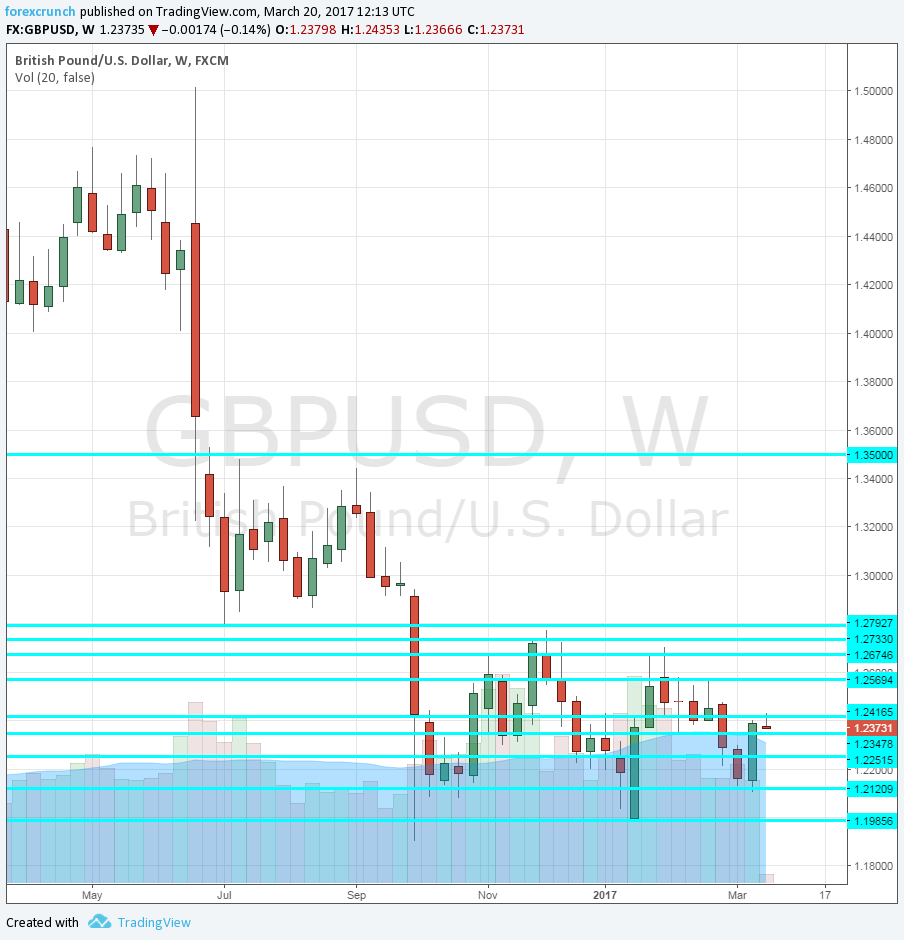

GBP/USD

The British pound is slightly lower on the announcement of the date, but the move is minuscule in comparison with the collapse seen after the referendum and the second drop back in October. Since then, cable has been relatively stable, ranging between 1.20 and 1.27, and was usually confined to a narrower range.

The weakness of the pound is already being felt by British consumers. While the wider economy enjoys robust growth that defies the gloomy forecasters (aka “Project Fear”), the higher prices have undermined consumption. According to some reports, there is a fall in purchases of non-essentials and a rise in expenditure on essentials such as food and energy. Official retail sales numbers have disappointed as well.

The Bank of England seemed to give a fight against the falling pound with its recent hawkish tilt. A stronger pound would stabilize inflation without a rate increase. Hiking the interest rate would hurt demand.

More:

- GBP: Hard Brexit Moving Closer: Time-Line & Targets – Danske

- GBP/USD: Brexit hurts more than Trump [Video]

Here is the weekly chart showing the development in pound/dollar since the vote.