The price of gold has been floating in a relatively narrow range. As the summer nears an end, there is a good chance that volatility will return to the precious metal. But in which direction will it go?

There are quite a few signs that point to a downfall in prices. Here are 5 reasons why the gold bears could awaken before the winter.

- Demand Falls: No other than the World Gold Council reported that demand fell by 7% in Q2 – the lowest in 2 years. This includes a drop of 38% in demand by India (which reportedly uses gold to pay Iran for oil), and China, which lowered demand by 7%.

- QE3: The rush for gold now mainly leans on the hopes for a third round of quantitative easing in the US, or money printing if you wish. A flood of dollar devalues currencies and raises the price of gold. However, the US economy isn’t deteriorating that fast, and Bernanke already stated that these programs have “diminishing returns“. A possible driver for QE3 could be a deterioration in Europe. However, things in Europe begin improving. In addition, one of the “swing” voters in the FOMC, Dennis Lockhart, who was open to QE, recently showed reluctance to act. The doves in the Federal Reserve cannot command a majority.

-

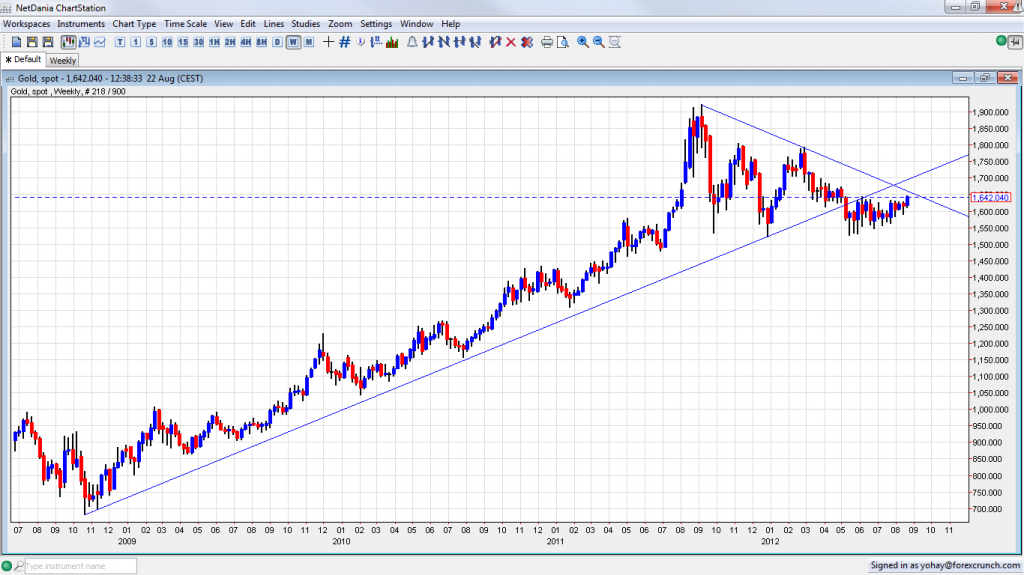

Technical: As the chart shows, the price of gold broke below uptrend support that accompanied it since the wake of the financial crisis in 2008. Since mid 2011, price is bound by downtrend resistance, which is now getting close. Will it fall from here?

Gold Under Downtrend Resistance – Click image to enlarge

- Analysts: “We’re of the view that we’re getting close to game over for gold,” says Nikos Kavalis from RBS, and he’s not alone. If we look at investors, we find George Soros, who more than doubled his investment in the SPDR Gold Trust. In 2010, Soros said that gold is a bubble, when the price only stood at $1100 at that time. Is Soros wrong again?

- Better investments: Gold doesn’t carry yield. Despite some record low interest rates in many developed countries, there still are some relatively higher yielding currencies, such as the Australian and New Zealand dollars. In addition, food prices are on the rise. And, even European stocks seem attractive to Marc Faber. This is especially relevant with the recent improvement in Europe, reflected in the German approval of a solution to the debt crisis in Spain. This makes peripheral bonds, stocks and also the euro attractive.

A similar article published here in September 2011 also suggested more room for falls. The price was then around $1727 and is $1639 at the time of writing this article. Of course, the price of gold may also break higher instead of lower.

What do you think? In which direction will the pair break?

Further reading:

In Depth Monthly Gold Analysis on Trading NRG (highly recommended).

I don’t cover gold on a regular basis as the focus is on currencies and gold is not a currency. However, gold, oil, stocks and currencies are all correlated.