The Canadian dollar has many forces moving it around. What’s next?

Here is their view, courtesy of eFXnews:

The Canadian economy’s close dependence on the US and oil industries means the ‘loonie’ has been highly vulnerable to political events regarding Trump’s presidency and OPEC’s oil supply freeze.

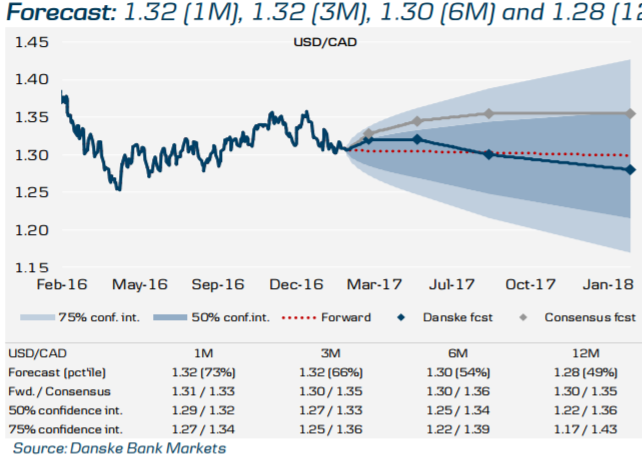

Our call for a near-term stronger USD should lift the cross near term, but we maintain the view that USD/CAD will end 2017 at a level lower than current as valuation and a normalizing growth outlook should work as a gravitating force on the cross.

We forecast USD/CAD at 1.32 in 1M (previously 1.33), 1.32 in 3M (unchanged), 1.30 in 6M (unchanged) and 1.28 in 12M (unchanged).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.