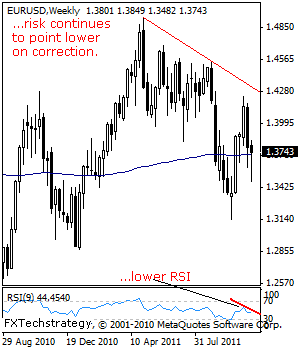

EURUSD: Follows Through Lower, Tests The 1.3604 Level (Weekly Technical Strategist).

EURUSD: The pair may have printed a hammer candle the past week halting its weakness at 1.3482 to close marginally lower but continues to remain vulnerable.

This leaves downside risk towards the 1.3604 level and its past week low at 1.3482 level where a violation will resume its weakness towards its Oct 10’2011 low at 1.3377 and then the 1.3144 level, its Oct’2011 low. Its weekly RSI is bearish and pointing lower suggesting further weakness.

Guest post by www.fxtechstrategy.com

Alternatively, the pair will have to break and hold above the 1.4241 level, its Oct 27’2011 high to end its present bear threats and bring further gains towards the 1.4342 level, its daily falling trendline and subsequently, the 1.4550 level, representing its Aug 29’2011 high.

All in all, with EUR bearish and targeting further downside, risk remains lower towards the 1.3482 level.

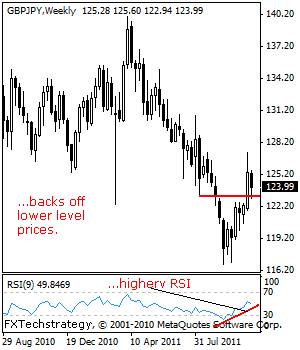

GBPCHF: Maintains Upside Bias, Sets The Tone For Further Strength (Week Ahead)

GBPCHF: With GBPCHF following through higher on the back of its previous week gains to reverse its three-day weakness and close above the 1.4447 level, its Oct 07’2011 high the past week, further strength is expected in the new week.

In such a case, its April 19’2011 high at 1.4702 level will come in as the next upside target with a clearance of there allowing for more bull pressure towards the 1.5179 level, its April 06’2011 high. Its weekly RSI is bullish and pointing higher suggesting further strength.

Conversely, on any correction, the cross will target its May 20’201 high at 1.4363 where a loss will open the door for further declines towards the 1.4296 level, its May 22’2011 high and subsequently the 1.3710 level, its Sept 20’2011 low.

ll in all, with the cross maintaining its corrective recovery tone set from the 1.1465 level, risk of further upside gain is envisaged in the new week.