The FX market is trapped in tight ranges ahead of the NFP release at 08:30EDT. From a technical perspective, we still think that US dollar is headed higher, but we need a catalyst and a confirming price action. This will of course be an impulsive reversal higher on dollar index, or lower on Euro.

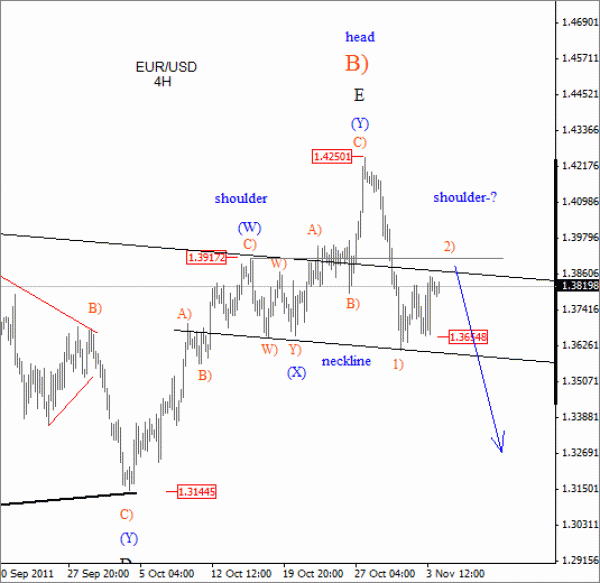

On the 4h Eur/Usd chart we still think that turning point is confirmed, after an impulsive fall well below corrective channel support line and also through 1.3800 swing low. As such, corrective wave E rally from 1.3144 is now considered as complete, which means that we expect further and powerful weakness in this market, in impulsive fashion once red wave 2) pull-back will complete; ideally around 1.39!

Guest post by Gregor Horvat

Notice that we are also looking at a possible head and shoulder pattern, which will put significant weakness in play, once the neck-line is taken out!

For more analysis visit us at www.ew-forecast.com and try our services with limited special offer *2 for 1* (get two months for price of one)

Here is one piece from article by a friend Yohay Elam regarding the NDP.

General scenarios for NFP:

+70K to 130K: The markets shake and quickly refocus on Greece. High probability.

+130K to 200K: The dollar weakens on a relief rally. High probability.

Above +200K: The dollar rallies on strong optimism. Low probability.

0 to +70K: The dollar strengthens on risk aversion. Medium probability.

A loss of jobs: The dollar gains a lot of ground as fear takes over. Low probability.

For a full article please click here!