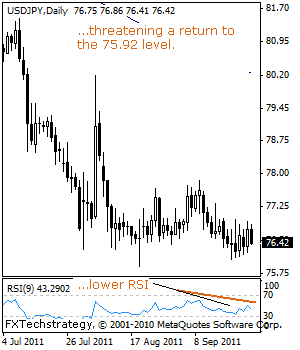

USDJPY: Consolidates With Downside Bias, Set To Target The 75/92 level (Special Focus).

USDJPY: The pair continues to consolidate but with downside bias. It looks to recapture the 75.92 level, its 2011 low and beyond.

USDJPY has been under a strong bear pressure since topping out at the 124.13 level in Jun’2007 and with that downtrend remaining intact, a convincing violation of the 75.92 level will set the stage for further weakness towards the 74.00 level.

Guest post by www.fxtechstrategy.com

Further down, support stands at the 73.00 level and then the 72.00 level, representing its psycho level. Its daily RSI is bearish and pointing lower suggesting further weakness.

Alternatively, the pair will have to break and close above the 77.85/80.19 levels, its Aug 04’2011/Sept 09’2011 highs to end its bear threats and create scope for further gains towards the 81.47 level, its July 08’2011 high and subsequently the 82.21 level.

All in all, USDJPY remains biased to the downside in the long term as it looks to resume that trend.

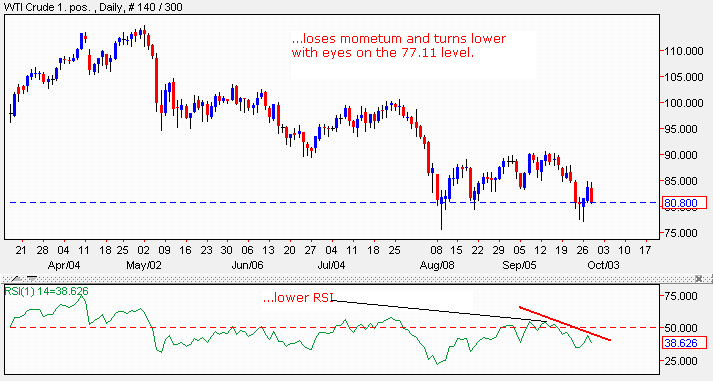

CRUDE OIL: Loses Momentum, Weakens Towards The 77.11 Level.

CRUDE OIL: With Crude Oil halting its recovery at the 83.64 level and taking back its Tuesday gains in today’s trading session, risk of a resumption of its medium term downtrend is now shaping up.

Pressure is building up on the 77.11 level, its Sept 26’2011 low and an eventual violation of that level will trigger further weakness towards the 76.61 level, its Aug 09’2011 low.

Below here if seen will pave the way for resumption of its medium term downtrend (started from the 115.46 level) towards the 74.41 level, its Sept’2009 low.

Further down, support lies at the 72.50 level, its July’2009 low. Its daily RSI is bearish and pointing lower supporting this view.

Alternatively, the commodity will have to climb back above the 90.69 level to reverse its present bear threats and bring further strength towards the 94.13 level, its Aug 03’2011 low and subsequently the 100.62 level, its July 26’2011 high.