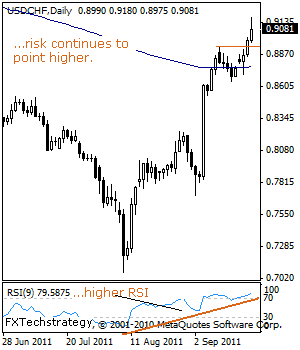

USDCHF: Strengthens Through The 0.9013 Level, Risk Opens For Further Gains.

USDCHF: The pair broke and held above the 0.9013 level, its April 19’2011 high on Thursday, opening the door for further bullish offensive.

Its present bullish momentum is coming on the heels of a violation of its key resistance at the 0.8929 level, its Sept 12’2011 high on Wednesday.

Guest post by www.fxtechstrategy.com

With a full-fledged bull pressure seen, a push towards the 0.9340 level, its April 01’2011 high is expected where a break if seen will aim at the 0.9400 level, its psycho level.

Its daily RSI is bullish and pointing higher suggesting further gains. Alternatively, support stands at the 0.9013 level with a breach targeting the 0.8929 level.

A reversal of roles as support is expected to occur at this level but if that fails, its Sept 15’2011 low at 0.8647 level will be targeted. Below here will pave the way for a move further lower towards the 0.8574 level and then its Sept 08’2011 low at 0.8532.

All in all, the pair remains biased to upside having resumed its short term uptrend.

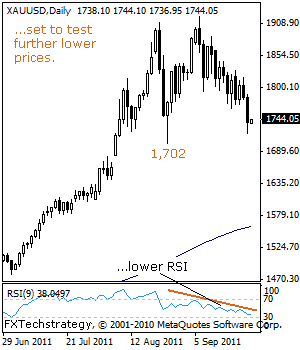

GOLD: Rolls Over, Set To Retest Key Support.

GOLD: The commodity may be preparing to end the week lower if a follow through on its Thursday losses continues.

Gold remains weak and continues to target lower level prices having triggered a corrective weakness off the 1,920.50 level in early Sept’2011.

A push further lower will bring the 1,702.31 level, its Aug 25’2011 low into focus with a loss of that level opening the door for further declines towards the 1,632.60 level, its July 29’2011 high.

Its daily RSI is bearish and pointing lower suggesting further weakness. On the upside, the commodity will have to break and hold above 1,920.50 level, its 2011 high to reverse its losses and resume its long term strength (now on hold) towards the 1,950 level followed by its big psycho level at 2,000.

We expect this level to present a considerable resistance and turn the commodity back lower if tested. All in all, Gold may be biased to the upside in the long term, but continues to face corrective weakness risks.