Today should be a quite interesting day with traders focusing on the German chancellor Angela Merkel and French president Nicolas Sarkozy meeting in Paris; who will attempt to ease market concerns about Eurozone debt troubles.

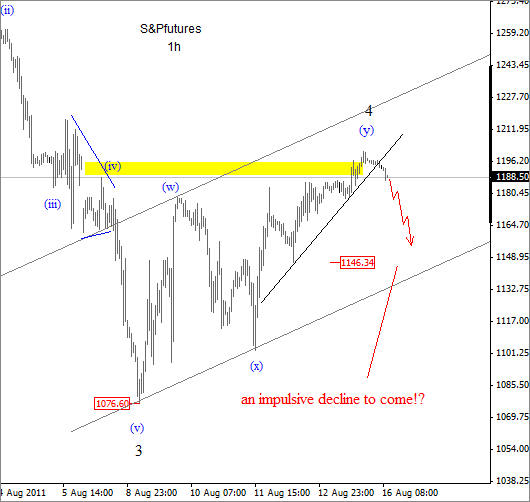

Why we also think that trading could be interesting is a technical outlook of the S&P Futures count, where a corrective recovery is running out of time. We should see a resolution very soon, which we believe it will be on the downside. We will keep an eye on a possible impulsive reversal from the top, which should send the US dollar higher after-that. In such case commodity currencies, such as Aud, Cad and NZD should weaken against the buck.

Guest post by Gregor Horvat

Looking at the euro, the overall price action is still very tricky there, but we may see some weakness coming, after German GDP for the first quarter was weaker than expected; 0.1% vs. 05%.

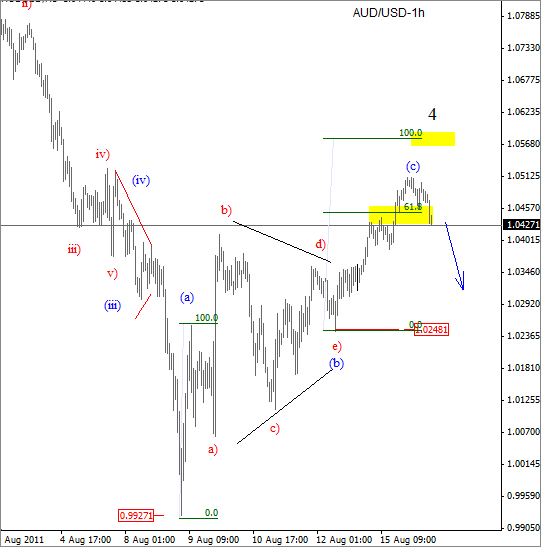

S&P Futures and Aud/usd technical outlook:

Recovery from the lows cannot be counted in five waves, so move is considered as a corrective, part of incomplete downtrend.

Aud/Usd has a very tight correlation with S&P Futures, which in fact also shows signs of a corrective recovery from its low. An impulsive reaction towards or below 1.03 will suggests that correction is done and that market is ready to move much lower.

For more analysis visit us at http://www.ew-forecast.com/

Follow us on twitter.