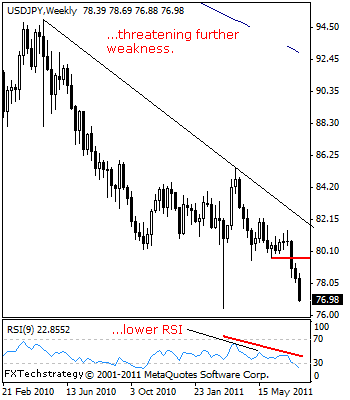

USDJPY: Bearishness Targets The 76.43 Level.

USDJPY: With a strong bearishness seen, further declines are now building up towards the 76.43 level, its 2011 low.

On a decisive cut through that level, USDJPY will resume its long term downtrend and weaken further towards the 74.00 and 73.00 levels, all representing its psycho levels.

Guest post by www.fxtechstrategy.com

Its weekly RSI is bearish and pointing lower supporting this view. On the other hand, a break and hold above the 81.27 level, its Jun 28’2011 high must be established to put its present downside vulnerability on hold and then aim at the 82.21 level.

Further resistance stands at the 83.27 level, its April 18’2011 high and subsequently the 85.49 level, its April’2011 high.

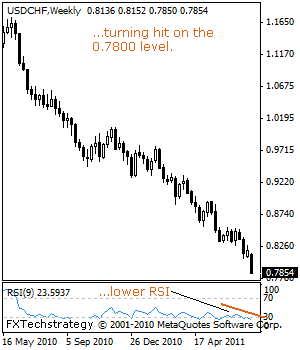

USDCHF: Sells Off, Resumes Long Term Downtrend.

USDCHF: A sharp sell off has seen the pair resuming its long term downtrend and opening the door for further weakness in the days ahead.

With that said, the 0.7800 level comes in as the immediate downside objective with a cut through that level allowing for more declines towards the 0.7700 level and then the 0.7600 level, all representing its psycho levels.

The use of its psycho levels as supports is necessary due to the absence of any visible support.

Its weekly and monthly RSI are bearish and pointing lower suggesting further weakness. On any recovery, its July 13’2011 low at 0.8079 will come in as resistance where a reversal of roles is expected to turn the pair lower.

Other resistance levels above the 0.8079 level are located at the 0.8524 level, its July 01’2011 high and the 0.8892 level, its May 24’2011 low.

All in all, USDCHF remains vulnerable to the downside in the long term as it looks to weaken further in the days ahead.