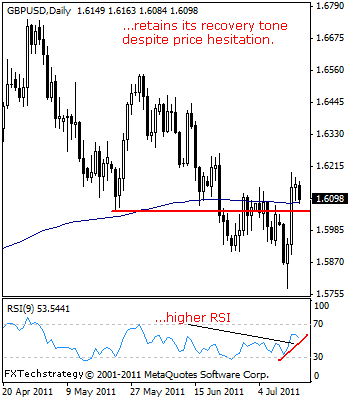

GBPUSD: Hesitating But Maintains Recovery Tone

GBPUSD: The pair’s failure to follow through higher on the back of recovery gains has triggered a fresh bear pressure.

However, GBP still retains most of its recovery gains started from the 1.5778 level and looks to strengthen further towards the 1.6193 level, its July 13’2011 high on ending the mentioned bear pressure.

Guest post by www.fxtechstrategy.com

Further out, resistance stands at the 1.6262 level, its Jun 22’2011 high. However, the ultimate test will be a return above the 1.6546 level, its May 31’2011 high.

If this is seen it will turn upside risk towards the 1.6743 level, its 2011 high and subsequently the 1.6877 level, its Nov’2009 high. Alternatively, the risk to this analysis will be a break and hold below the 1.5778 level.

In such a case, the 1.5749 level, its Jan 25’2011 low will be targeted followed by the 1.5700 level, its psycho level and then the 1.5600 level.

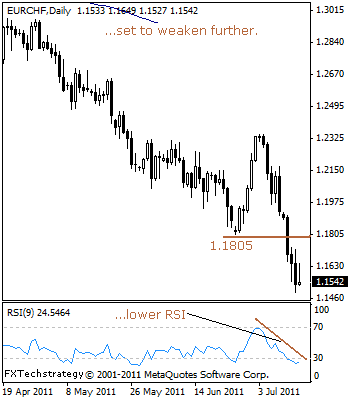

EURCHF: Set To Weaken Further On Trend Resumption

EURCHF – The cross remains biased to the downside with further declines envisaged having resumed its long term downtrend.

This development leaves the cross targeting the 1.1400 level, its psycho level with a violation of that level calling for further weakness towards the 1.1300 and the 1.1200 levels, all representing its psycho levels.

Both its daily and weekly RSI are bearish and pointing lower supporting this view. Alternatively, on any recovery higher, the 1.1722 level will be targeted with a turn above there allowing for further strength towards its Jun 26’2011 low at 1.1805.

A reversal of roles as resistance is expected at this level thus turning the cross back lower in the direction of its long term downtrend.

Further resistance stands at the 1.2345 level and then the 1.2468 level, its Mar 24’2011 high.

All in all, EURCHF remains biased to the downside as it looks to weaken further having resumed its long term weakness.

.