EUR/USD had a nice ride to the topside, enjoying the weakness of the Donald Dollar as well as positive data from the euro-zone. SocGen is short into this rally:

Here is their view, courtesy of eFXnews:

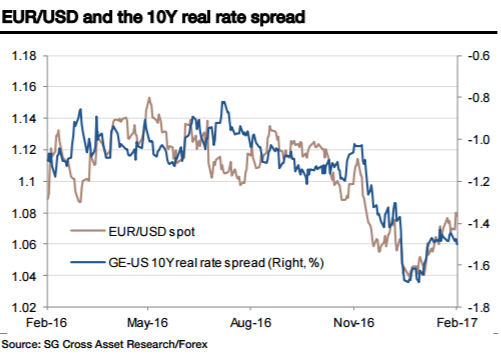

All the jawboning is chopping FX rates around all over the place, and I’ve been reading more and more about de-coupling between the dollar and bond yields. It’s too early to conclude that. It’s not the short-term rates that matter to me, or nominal ones, but relative real long-term yields. Those have been a good indicator of FX trends since 2015 and still seem to be. But US real yields, after jumping sharply at the end of 2016, have settled into a choppy range, 30bp or so below their peak. And that in turn has left USD/JPY chopping around some way below its peak and EUR/USD meandering around above its low.

At the margin, yesterday’s Euro jump looks excessive, but that’s noise, and the kind of move we’ll get while the bigger story of relative interest rate moves is in abeyance.

….And the FOMC meeting is today’s main event even if lots of people aren’t paying attention. They won’t change policy, they will remain in wait-and-see mode, but inflation is rising and the economic data are solid. Meanwhile, we said we wanted to short EUR/USD around 1.07/1.08 and here we are…

*SocGen maintains a short EUR/USD position from 1.07.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.