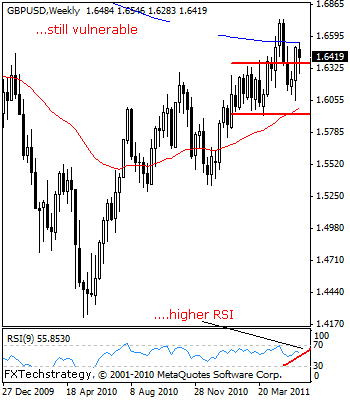

EURUSD: Strengthens, Closes In On The 1.4938 Level.

EURUSD: A strong rally at the end of week saw the pair cutting through its May 09’2011 high at 1.4441 to close higher for a third week in a row since turning off the 1.3970 level, its May 23’2011 high.

This development has put EUR on the path to the 1.4938 level, its 2011 high where a sustained break will resume its long term uptrend and clear the way for further strength towards the 1.5140 level, its 2009 high.

Guest post by www.fxtechstrategy.com

Its weekly studies are bullish and pointing higher supporting its current bullish tone. Alternatively, on any pullback, initial support stands at its May 09’2011 high at 1.4441 where a reversal of roles as support is likely to occur and turn the pair back up.

However, a loss of that level will open the door for more declines towards the 1.4345 level, its May

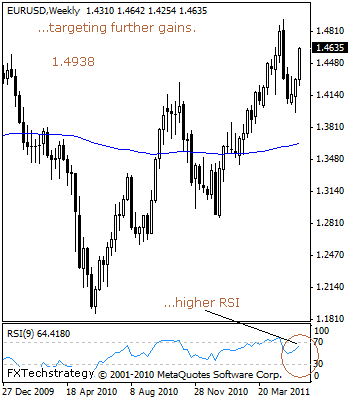

GBPUSD: Struggling To Return Above The 1.6546 Level

GBPUSD: While a two-day gain may have halted the pair weakness, it still closed lower in the past week suggesting its vulnerability.

Unless a return above the 1.6546 level, its 2011 high occurs, we may see GBP turning lower below the 1.6056 level, its May 24’2011 low.

With that said, if the former argument (upside move) prevails, further strength should build up towards the 1.6743 level, its 2011 high and then the 1.6877 level, its Nov’2009 high.

A loss of the latter level will pave the way for more price extension towards its bigger resistance standing at the 1.7039 level, its 2009 high. Its weekly RSI is bullish and pointing higher suggesting further strength.

Alternatively, in the absence of the above scenario, risk of a decline back towards the 1.6056 level, its May 24’2011 low cannot be ruled out with a break setting the stage for more weakness towards the 1.5935 level, its Mar 28’2011 low.