In its last meeting of 2016, the ECB continued expressing worries, extending the QE program while reducing the quantities from April 2017 and allowing for a wider range of bond buys. The euro reacted negatively. What will Draghi and co. announce in the first meeting of 2017?

Here is their view, courtesy of eFXnews:

We do not expect a hawkish stance from the ECB, although the latest economic survey indicators have strengthened further and inflation has risen above 1.0% for the first time in three years. President Mario Draghi will most likely argue that the ECB does not react to a single inflation figure, that the latest inflation gains are due primarily to energy prices and consistent with the ECB’s inflation forecast – broadly in line with last week’s comments from the hawkish executive board member Yves Mersch.

The higher inflation is good news for the ECB but it seems clear that the underlying price pressure is most important and here there are ‘no signs yet of a convincing upward trend’. ECB executive board member Benoît Cæuré said recently, ‘we are still waiting for signs that core inflation is on the rise and will clearly exceed 1%’. We expect core inflation to stay below 1.0% for most of this year, while the ECB looks for a rise to 1.1% on average.

Although tapering speculation is likely to be boosted in coming months by rising inflation, the ECB has, in our view, sidelined itself until H2 with the latest QE extension. We expect headline inflation to rise temporarily above 1.5% but to come back below 1.3% and stay there in H2 17.

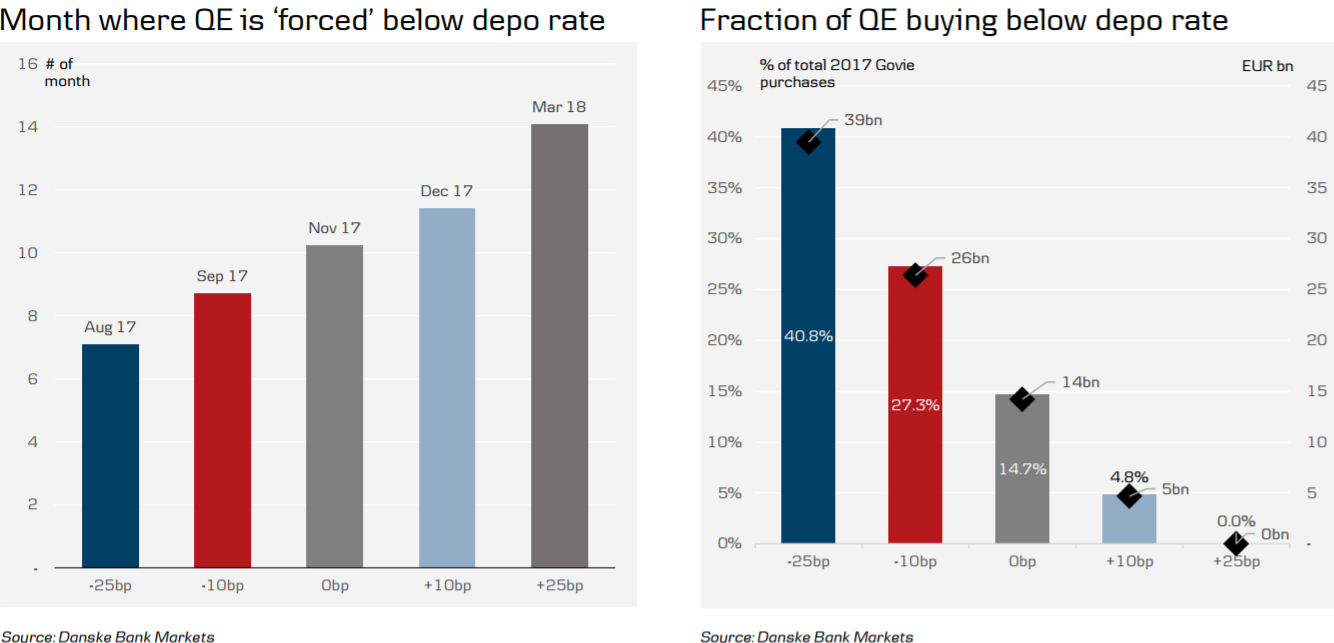

Based on this, we expect the ECB to extend its EUR60bn monthly QE purchases into 2018.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.