Trump’s upcoming inauguration convinces many, including in this neck of the woods, to see upside for the US dollar. Nevertheless, Barclays takes the opposite trade:

Here is their view, courtesy of eFXnews:

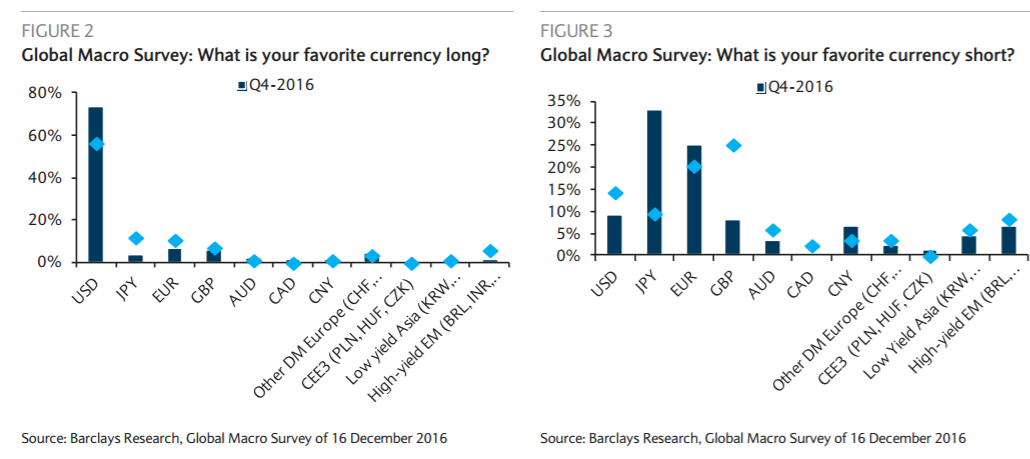

Most sentiment-sensitive currencies have appreciated versus the USD over the past three weeks as long-end US interest rates declined and most equity and commodity prices increased. Movements in favorite long-USD positions versus the JPY and EUR, according to our December 2016 Global Macro Survey (Figures 2 and 3), however, were much more constrained.

Despite some USD weakness last week, USDJPY is currently around 13% higher, and EURUSD is about 6% lower than at the end of Q3. According to Barclay’s FX volume (VoLT) and CFTC futures data, positioning in these pairs also remains historically stretched. While we retain our broadly bullish USD view for this year, impending US political risk may lead to some near-term USD consolidation against major currencies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

This week will see the beginning of the confirmation hearings for President-elect Trump’s administration officials. While the appointees will likely be confirmed, additional Democratic scrutiny could induce delays and cause some to question the speed of policy implementation. A strong trade protectionist tone in the hearings of Wilbur Ross (Commerce Secretary nominee) and Robert Lighthizer (Head of US Trade Representative Office nominee) may also worry markets as they make their first formal policy statements. Trump’s press conference on Wednesday and inauguration speech (21st January) are also likely to bring about a reassessment of the market’s view on the White House policy agenda.

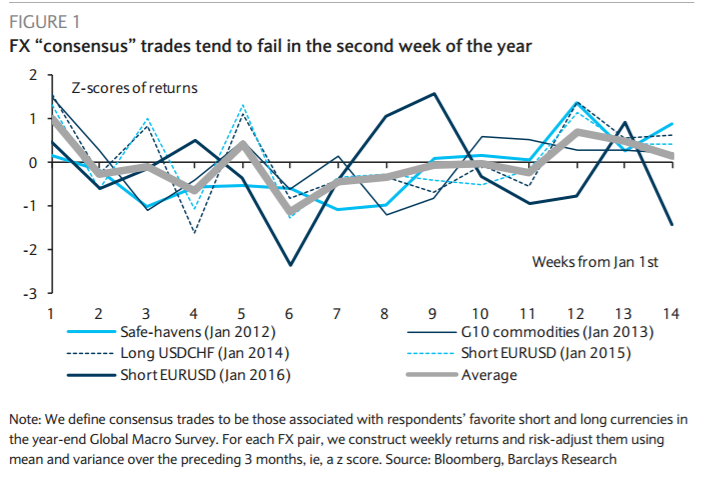

Near-term USD weakness is liable to be greatest for “consensus” USD long trades, which tend to perform poorly in the first part of the year, despite an often positive start (Figure 1). We define FX consensus trades to be those associated with respondents’ favorite short and long currencies in the year-end Global Macro Survey, thus providing an indicative measure. We then calculate risk-adjusted weekly returns and note that, from the second week of January, such trades tend to deliver poor returns. This behavior seems quite stable on average and is also present in equity market consensus trades. Our ability to identify consensus trades for non-FX assets is limited by the type of questions asked in the survey, and the sample size varies by asset class. In the December 2016 Global Macro Survey, investors reported a willingness to be long USD and short JPY and EUR. The future US policy uncertainty could be the catalyst that introduces short-term risks to these trades.

While we retain our broadly bullish USD view for this year, impending US political risk may lead to some near-term USD consolidation against major currencies. The relatively light agenda for the JPY, EUR, and GBP make them three likely candidates for investors to reduce long dollar positions.

Moreover, all three currencies were indicated among the favorite short among the respondents of the Global Macro Survey. Hence, we can take an anti-“consensus” view. We recommend avoiding short USD positions against CAD, AUD, and NZD, however, as they are more exposed to Trump’s protectionist measures.

We target 2% appreciation of the JPY, EUR and GBP equally weighted basket versus the USD, with a stop-loss of 1%.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.