The US dollar crashed (here are three reasons). The team at Morgan Stanley sees buying opportunities on the main pairs:

Here is their view, courtesy of eFXnews:

US labor market focus:

Yesterday’s release of US Fed minutes showed that about half of the participants incorporated an assumption of more expansionary fiscal policy in their forecasts. In their discussion of their economic projections, participants emphasized their considerable uncertainty about the timing, size, and composition of any future fiscal and other economic policy initiatives as well as about how those policies might affect aggregate demand and supply. The Fed expressing these uncertainties may have contributed to the USD overnight retreat, but it has increased as well the potential impact of Friday’s US December labor market report.

A high reading adding to our perception the US is closing its output gap should put the USD back into its bullish trend. MS’s Ted Wiseman predicts an above market NFP gain of 185k.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Trading USD Correction:

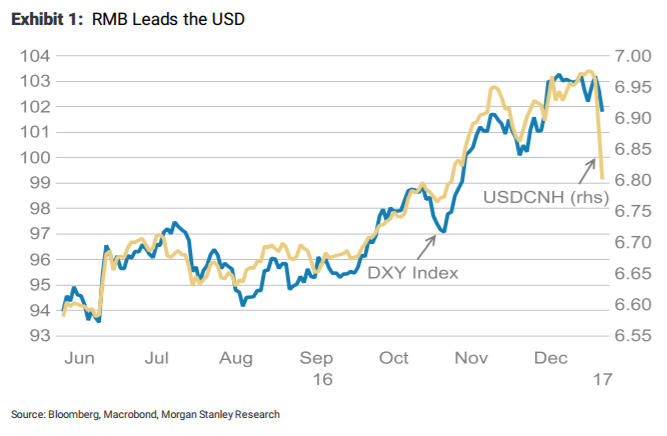

China taking care of this risk is good news for global reflation and since USD bullishness against low yielding currencies is part of this reflation trade we suggest that the current USD correction will prove to be a short-term affair. In particular, we would exclude an outcome experienced last year when a change in the Fed’s rhetoric caused the USD to fall back by 6.5%.

USD corrections within the current environment should not exceed 2%, suggesting EURUSD near 1.0650 providing a selling opportunity and USDJPY near 114.45 providing us with a buying opportunity.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.