It has been a little more than a year and two weeks since the Swiss National Bank simply could not hold the line any further in its defense of a weakening Euro. The SNB was not under any obligation to maintain a peg, but rather agreed to one in order to maintain purchasing parity with Eurozone trade under a 2011 agreement. The unexpected move shattered markets. The Franc moved from 1.20 to 0.9926 in a virtual straight drop; a gain of 17.283%. A few days later it was at 0.98615; the 2015 high.

For comparison, the Franc started 15 January at 1.5442 per GBP spiked to a high of 1.2973 per and closed at 1.4120 Franc per GBP; a gain of 8.56%. The Franc started 15 January 2015 at 1.01 per USD, spiked to 0.8351 per USD and closed at 0.9286 per; a gain of 8.059%. Lastly, the Japanese Yen opened 15 January, 2015 at ¥114.2091, plunged to ¥138.93 and closed at ¥136.57; a decline of 20.589% for the Yen. The chart demonstrates where the majors are currently with respect to the Swiss Franc. Note that it’s about half way from where the SNB wishes to be against the Euro: 1.20 per.

Guest post by Mike Scrive of Accendo Markets

On 8 January, an SNB press release noted a full year 2015 loss of 23 billion Francs (£16.312). Of the 23 billion CHF, “…The loss on foreign currency positions amounted to CHF 20 billion. A valuation loss of CHF 4 billion was recorded on gold holdings…” The statement points out that “…despite the annual loss, the resulting balance sheet profit will allow a dividend payment of CHF 15 per share as well as the ordinary profit distribution of CHF 1 billion to the Confederation and the cantons…” The local economies of the confederation’s cantons rely on the yearly dividend from the SNB distribution.

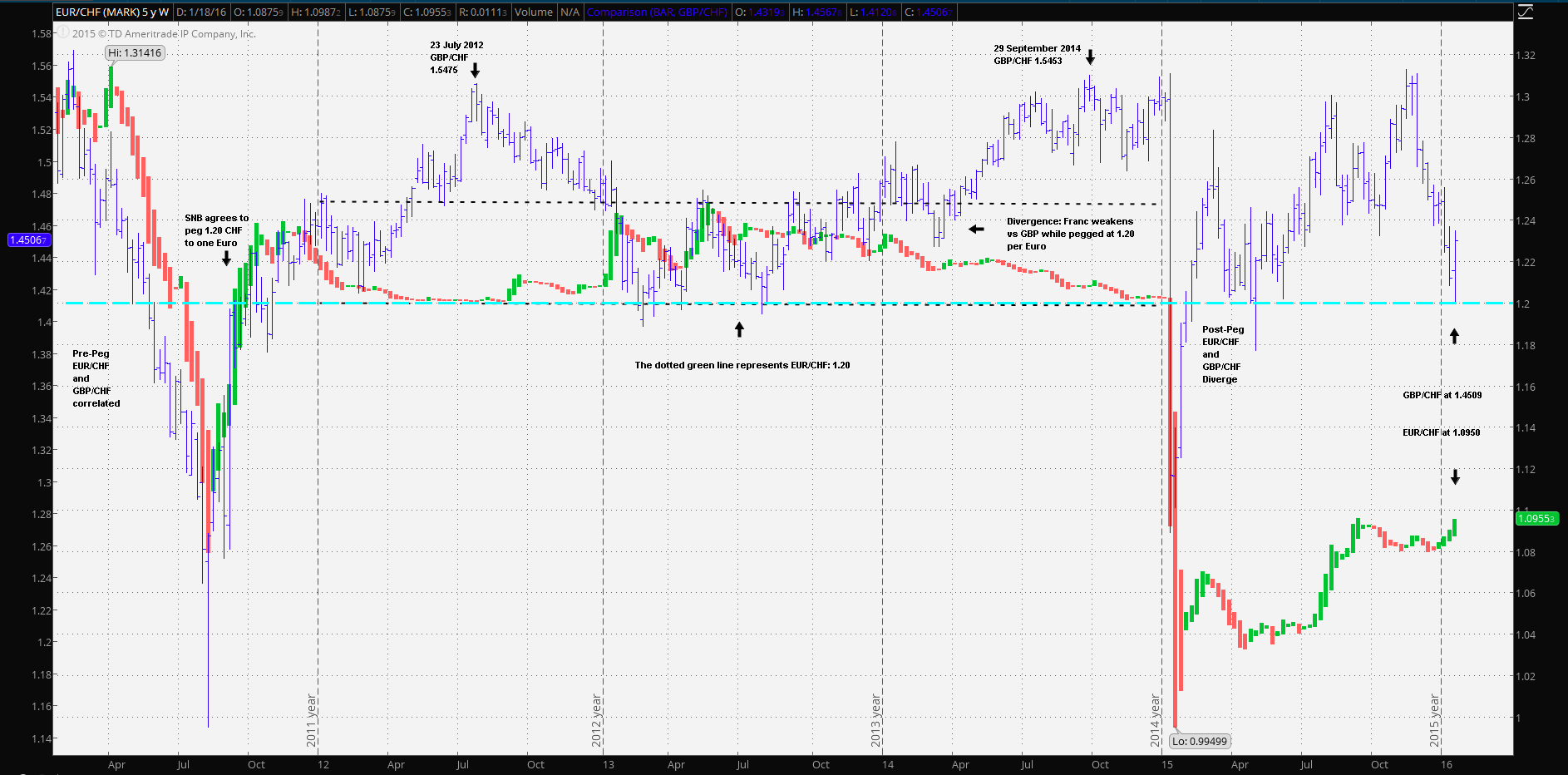

It’s also important to note how far out on a limb the Swiss National Bank extended its efforts to maintain the peg before it found it necessary to let the chips fall where they may. This decision must have caused quite a bit of angst for the Governing Board. To put it in perspective, it’s necessary to consider a longer term chart starting from the time the SNB instituted its 1.20 CHF per Euro in September of 2011. The low was attained in April of that year at 1.31416 CHF. It’s clear to see where the peg went into place, (dotted line channel; 1.20 support, 1.25) resistance and it was maintained for almost exactly three years.

An overlay of GBP/CHF starting at the same time is a good reference. Note that before the SNB began the peg both EUR/CHF moved with ‘similarity’. However, as the Greek debt crisis gained momentum in the first quarter of 2012 the Franc began to weaken against Sterling but literally flat-lined at 1.20 from April through August. For almost all of 2013, GBP/CHF came back in line with EUR/CHF. As reported in the Wall Street Journal in January of 2013, the SNB was vigorously defending the peg accumulating over 400 billion CHF in ‘currency investments’ by the end of 2012 and an additional 80 billion CHF in other assets; an increase of about 150% over a little more than a year. It’s reasonable to conclude that by the beginning of 2014, the SNB was stuffed to the gunnels with Euros.

What was to become known as ‘austerity’ imposed by the ‘Troika’, was put into place in 2013, but with unemployment at over 26%, government job firings, extremist politics and riots began to threaten the stability of the Greek government . The point of the matter is that the SNB was tied to the Euro, which was being stretched to the limit with successive ‘bail-outs’, some on shaky footing. Again, referring to the above chart, for the year 2014, the GBP/CHF overlay demonstrates, by the increasing divergence of the two, just how much the Franc weakened while tied to the Euro. By the last quarter of 2014 Prime Minister Samaras was looking for a way out of the ‘aid package’, thus setting off a new round of default concerns. The divergence between EUR/CHF and GBP/CHF clearly indicates the amount of capital the SNB was putting into the peg. The Franc ended 2014 near its 2012 July low vs Sterling; about 1.53 Franc per and flat-lining at 1.20 support vs the Euro while pouring capital into the peg. It was a massive effort on the part of the SNB.

Two weeks later the SNB shook the financial world. The divergence between the decoupled EUR/CHF compared to GBP/CHF gives an idea where that 23 billion Franc loss occurred. It wasn’t just weeks or months, but consecutive years of selling Franc reserves and buying Euros. Yet, many analyst questioned the move and all seemed to agree is was a surprise. UBS Wealth Management CIO Mark Haefele stated “…The move has come as a complete surprise and the Swiss National Bank showed no indication of reducing its commitment to the floor in advance of this move…” Many comments were on the same lines. However, there were some quotable exceptions which more clearly echo the facts. Luke Bartholomew, investment manager at Aberdeen Capital noted that “…Switzerland’s problem is that it is almost too credible as a safe haven. People desperately want to hold the currency to shield themselves from the risks they see elsewhere, particularly in the euro area…”

The saga of the Swiss National Bank’s commitment to a peg in September of 2011 is a textbook lesson in complacency. A simple comparison with GBP/CHF vs the Franc would have made clear that the peg was indeed unsustainable, or at the very least worthy of a hedge. This is further evidenced in the 8 January 2016 Press release reporting the sizable 2015 loss. It indicates clearly that the SNB had little other choice, especially at the time when the ECB was signaling an expansion of its QE.

The SNB has made it clear that the Franc is still overvalued. The question then becomes: what would the SNB consider fair value relative to its peers? If the above comparison is any indication, observe the (light blue) price level marking GBP/CHF at 1.4114 which just happens to correspond to 1.20 CHF per Euro.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”