The Australian dollar had a relatively stable year in 2016, but this may not last too long. Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

Last year, the AUD often appeared on top of many selling recommendation lists. Not so this year, where we feel markets may not recognise the entire AUD downside potential.

For starters, AUD-USD sovereign yield differential is at historic lows. Hence, the AUD qualifies less as a ‘yielding currency’, bearing in mind that Australia’s net foreign liability position has further deteriorated. Its banking sector has reduced its wholesale funding exposures since the financial crisis, but within an international comparison its banks still feel the impact of rising USD funding costs more than most other G10 banking sectors.

An interesting read is provided by the most recent BIS release examining the international impact of changing funding costs of the USD, EUR and the JPY. Countries with high foreign funding needs should be most exposed within an environment of rising international funding costs.

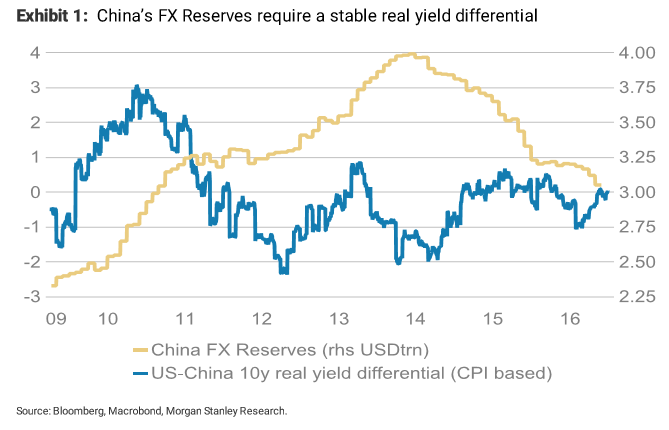

Add to this mix global trade and Chinese growth risks and the outcome should be a much lower AUD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The dominance of USD strength prevented the AUD from benefiting from rising commodity prices and the associated terms of trade improvement. Going into December, the AUD started to underperform other currencies, which we have partly exploited running AUD shorts against the CAD and the NZD.*

In its strategic portfolio, Morgan Stanley maintains a short AUD/NZD from Nov 17, and a short AUD/CAD from Dec 01.*

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.