The Bank of Canada decides for the last time in 2016. What will it be? Here are three previews:

Here is their view, courtesy of eFXnews:

CAD: BoC On Hold For Sometime But Risks Slightly To The Downside – Nomura

The Bank of Canada (BoC) holds its next policy meeting on Wednesday. At the October meeting, Governor Poloz surprised market during the press conference by admitting that “the Governing Council actively discussed the possibility of adding more monetary stimulus at this time, in order to speed up the return of the economy to full capacity.” Since then, not much has changed with the data since the October meeting continued to confirm that the economy is rebounding following the contraction in Q2 due to the impact of the wildfires on the oil sector. However, the underlying momentum in other sectors of the economy remains weak. Notably, non-energy exports continue to underperform and latest GDP data showed that domestic demand remains weak. Nevertheless, Gov. Poloz indicated recently that the economic situation has not changed much since October, suggesting the Communiqué is likely to be little changed.

We expect the BoC to leave its policy rate unchanged on Wednesday. We also believe that it will reiterate that risks on inflation remains roughly balanced.

We continue to believe that the BoC will leave its policy rate at 0.50% for some time, but risks could be slightly to the downside given the negative risks to growth coming from the election of Trump (se). Linked to this, the performance of non-energy exports remain key.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

CAD: BoC Firmly On Hold On Wednesday – Goldman Sachs

Bank of Canada to be on hold today (Wed). Before the ECB on Thursday and the Fed and BoE next week, the Bank of Canada will have a say. Growth in Q3 was a bit stronger than the BoC expected (3.5 percent vs. 3.2 percent expected by the BoC), and the risks to Q4 also now look to be on the upside (2.0 – 2.5 percent vs. 1.5 percent) (Exhibit 1), even as exports have been lackluster (Exhibit 2).

![]()

Taken together with the recent OPEC decision, the BoC should be firmly on hold this week. Governor Poloz recently said a rate cut would take an “accumulation of evidence” that growth is falling short of its forecast. That seems unlikely to be their assessment not only this week, but also by the January forecast round. This week is a non-MPR meeting, meaning there will be no press conference and no formal forecast update – just a statement at 10am ET.

CAD Into BoC: 3 Driving Factors; Where To Target – BofA Merrill

We expect the Bank of Canada (BoC) to keep policy rates on hold at 0.50% at is meeting on Wednesday as is widely expected. In the absence of a Monetary Policy Report (MPR) or press conference, the tone of the statement will be a key determinant of the market reaction. With data since the October MPR largely in line or a bit better-thanexpected, the BoC will likely maintain its assessment that risks around the inflation outlook are “roughly balanced.” Additionally, the overall tone is still likely to be one of cautious optimism even as Governor Poloz noted that uncertainty remains extremely high in recent comments. Overall, the statement will suggest—as Poloz did in comments this week—that absent a material shock to their inflation outlook the bar for a cut remains relatively high.

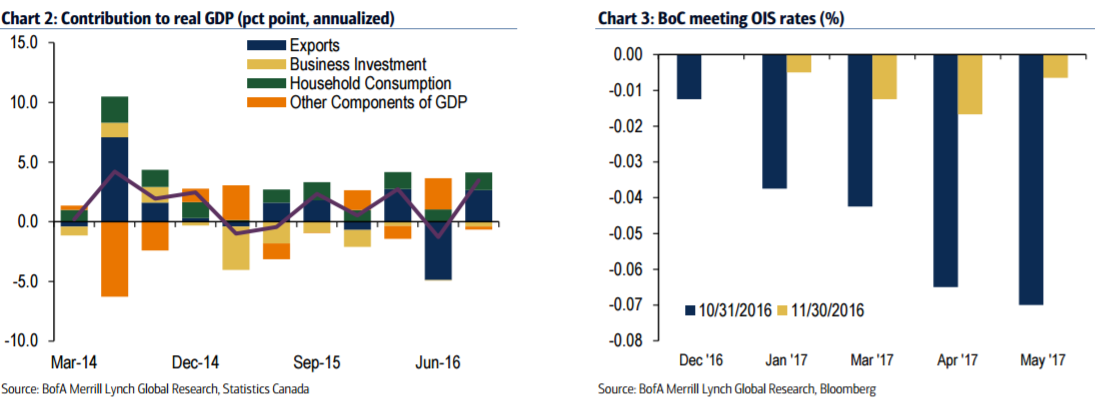

Data: good, not great. Recent data leaves little to push the BoC off its comfortable, on-hold perch. Q3 GDP outpaced the BoC’s October MPR forecasts of 3.2%, driven encouragingly by a rebound in exports from Q2 and still strong household consumption (Chart 1). The bounce in exports fits the BoC narrative the exports will help support a rebound in H2 growth, but it still wasn’t enough to offset the sharp Q2 decline. Additionally, the continued weakness in business investment is likely to leave them cautious about a strong pickup in manufacturing in coming quarters. Employment data has also remained strong with the 6m trend accelerating to an above-trend 20k. On the flip side, the trade balance reached its widest level on record (about 3% of GDP) as export growth remains uneven…

Tighter financial conditions from US spillovers. The 50 basis point rise in US yield since the election has brought Canadian yields higher as well, posing some concern about a premature tightening of financial conditions. Despite the rise in US yields, the Canadian dollar trails only the British pound in its relative outperformance versus the USD since the election. It is likely too early to expect.

FX: Focus on Fed, US yields with high hurdle for near-term BoC cut. The BoC’s on-hold stance is likely to have short-term little impact on USD/CAD, particularly with market pricing consistent with little (if any) BoC action through mid- 2017. However, with the OIS curve relatively flat (Chart 2), we continue to believe the market is underpricing the risks around the Canadian economy. The pricing out of cuts since the October meeting has been one reason the C$ has performed well, despite broader USD strength and additional risk premia from Trump-induced trade policy uncertainty. However, USD/CAD’s inability to sustainably selloff following OPEC’s surprise decision to cut production by 1.2 mn bbl/day suggests the market is more focused on the global yield story than oil price movements. Indeed, $50/bbl WTI prices are still below the full cycle breakeven costs of many Canadian producers.

We continue to expect a sustained move higher in USD/CAD towards year-end and over the course of 2017 driven by: 1) a faster pace of Fed hikes than the market is currently expecting, 2) a tepid pace of Canadian growth as capacity and competitiveness issues hamper non-energy exports leading to a BoC cut in H2 2017, and 3) increased uncertainty with respect to Canadian trade as President-elect Trump seeks to renegotiate trade deals.

With oil prices likely to move higher post-OPEC, implicitly we are assuming the recent decline in correlation between CAD and oil will continue to be displaced by rate differentials. As we have show empirically, CAD’s sensitivity to rate differentials has increased in recent years. While higher oil will lend some residential demand for CAD, we expect the rate story to dominate over the coming years, underpinning our bearish view.

BofA Merrill targets USD/CAD at 1.36 by year-end and at 1.38, 1.40, 1.41, 1.43 by the end of Q1, Q2, Q3, and Q4 of 2017 respectively.