As December begins, many are already eying the next year: 2017. The team at Dankse has you ready with 4 themes, 9 trades and 1 wild card:

Here is their view, courtesy of eFXnews:

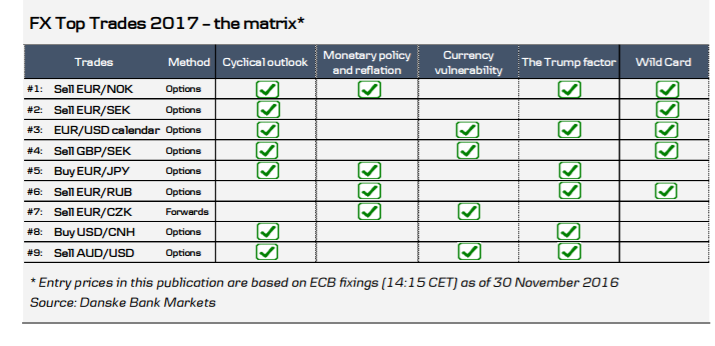

We present our year-end FX Top Trades for the coming year. We base the 2017 publication on four themes we think will drive FX performance in 2017: (i) cyclical outlook, (ii) monetary policy and reflation, (iii) currency vulnerability and (iv) the Trump factor.In addition, we have a ‘wild card’, which is our tail-risk scenario.

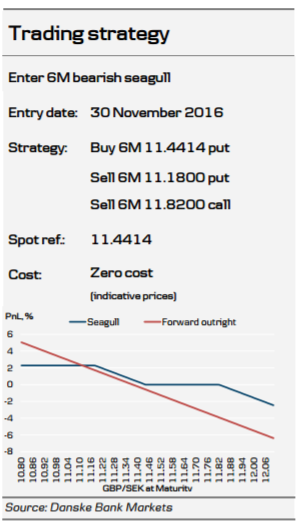

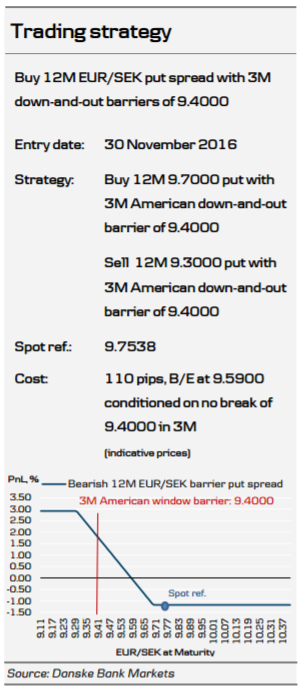

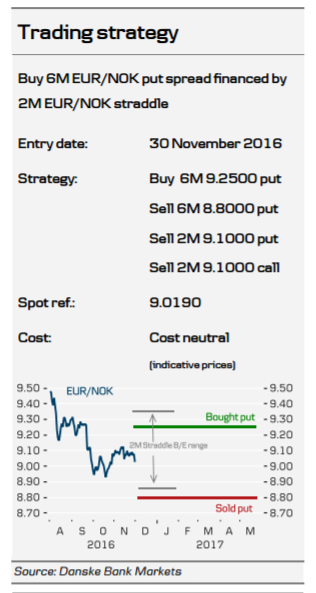

The global recovery engine is set to turn towards developed markets from emerging markets. This is likely to make carry trades vulnerable, while long FX volatility strategies become right skewed. The Scandi outlook suggests a bullish NOK stance but a more cautious SEK stance.

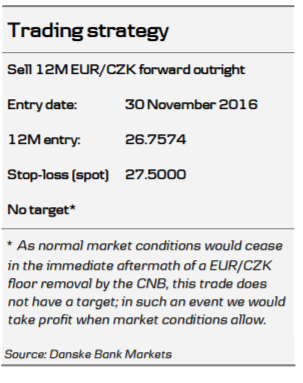

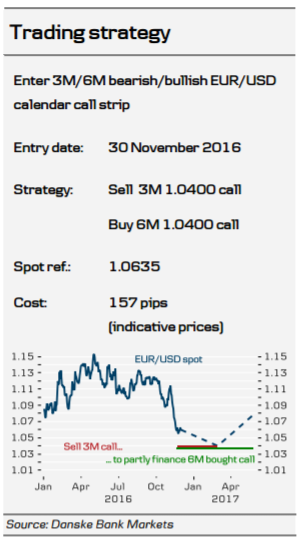

Inflation is likely to increase in 2017 and monetary policy conditions are set to tighten. Market pricing leaves scope for hawkish CZK surprise. Higher global inflation is likely to support CEE and commodity currencies, while an increase in 10Y UST yields would be JPY negative.

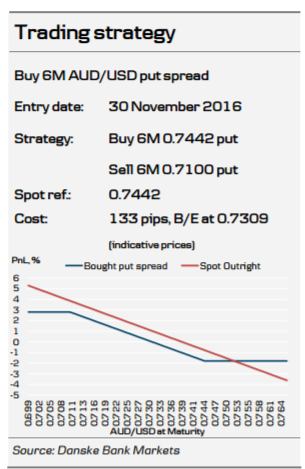

We score currencies according to current account misalignments, valuation mismatches and net international investment positions. Based on the scorecard, there is upside potential for HUF, CZK, EUR and PLN, while USD and AUD have downside correction potential.

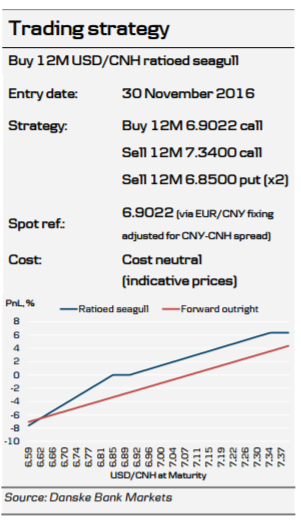

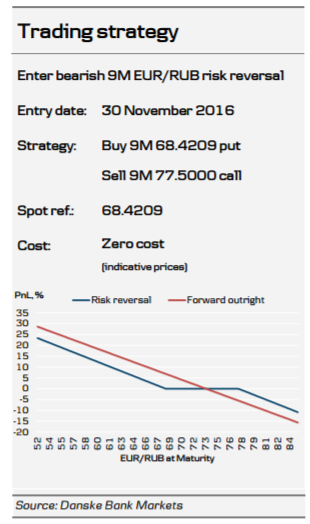

The Trump presidency is likely to have a large impact on FX markets in 2017 via the potential of the Homeland Investment Act 2, positive supply-side policies, higher infrastructure spending and more protectionist policies. The ‘Trump factor’ is set to be negative for JPY and CNY and positive for NOK, RUB and CAD.

In our wild card scenario, we consider political instability in Europe. In our view, a sharp increase in political uncertainty in Europe would be EUR negative and create demand for traditional ‘safe havens’ such as CHF, JPY and DKK.

As in previous versions of FX Top Trades, entry prices are based on ECB fixings (as at 14:15 CET on 30 November 2016). In line with 2015, we include both forward outright and option ideas. Our forward outright recommendation will be included in the Danske Bank FX Trading Portfolio, in which we consider only spot and outright FX trading recommendations. For option trades, we provide updates to our P&L.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

And here is more: