The Australian and New Zealand dollars struggled during the month of November and could continue enduring pressure in the last month of 2016:

Here is their view, courtesy of eFXnews:

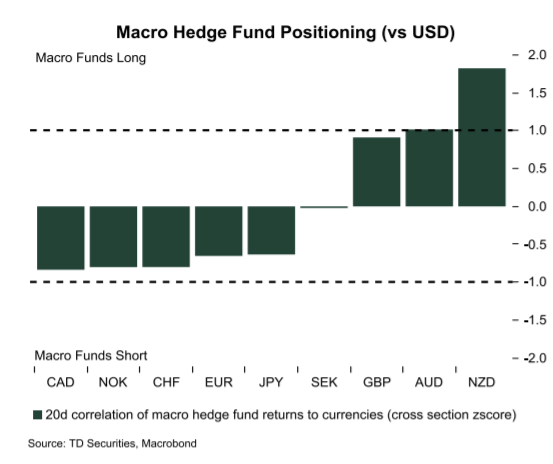

The chart below shows our proxy for macro hedge fund positioning. It suggests that macro funds are short oil currencies but long high-beta currencies like AUD and NZD. It also indicates that they are short low-yielding currencies, notably EUR, CHF, and JPY. Our positioning indicator is reaching levels where the news flows can trigger squeezes.

For one, we think an OPEC deal will boost oil-linked currencies like CAD and NOK, though we prefer the latter on a knee-jerk oil pop.

We also suspect that barring some immediate downside risks into the Italian referendum much of the bad news is priced into the EUR in the near-term.

We also like fading the rallies in AUD and NZD, as risk aversion is likely to pickup in December. This reflects the seasonal bounce in FX volatility, stretched valuation, and ongoing political uncertainty across the majors that also benefit JPY.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.