Flash PMI data released last week from IHS Markit suggested that economic recovery in the euro area strengthened in October, largely due to the increase in the manufacturing sector. The Purchase Managers Index (PMI) released by IHS Markit showed the composite output index rising to 52.7 in October, marking a 10-month high and follows up from 52.6 in September.

Flash services PMI activity index rose to a 9-month high at 53.5 in October, compared to 52.2 in September while manufacturing PMI rose to 54.4 marking a 10-month high. Despite some softness in the services sector, the sub indexes in the manufacturing sector pointed to an all round increase in employment, the backlog of orders, news orders and input and output price increases.

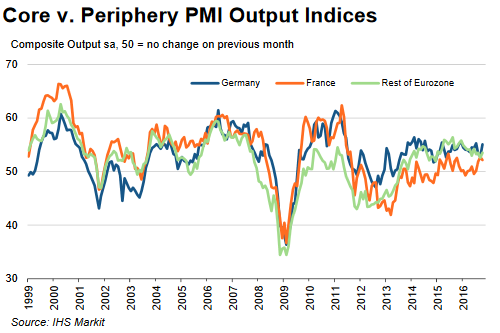

The acceleration in the pace of economic activity in the euro area came with strong growth from Germany, but at the same time, growth was seen slowing in France, two of the biggest economies in the euro area. The divergence between the two economies were clear as German growth increased in October, marking the second largest monthly increase this year so far, while at the same time, growth in France and other regions in the euro area managed to rebound from a 21-month low in September but was still weaker in comparison to Germany.

Germany leading Eurozone growth

October Flash PMI Summary

| Output | Composite | Strongest rise in output since December 2015 |

| Services | Expansion at a 9-month high | |

| Manufacturing | Output growth at a 10-month high | |

| New Orders | Composite | New business growth strengthens further |

| Services | New business index increases at the fastest pace in 6-months | |

| Manufacturing | New orders growth at 4-month high | |

| Backlogs of work | Composite | Rising at the strongest pace since May 2011 |

| Services | Outstanding business increases for the fourth consecutive month | |

| Manufacturing | Backlogs rise at the fastest pace since January 2014 | |

| Employment | Composite | Job growth at 3-month high |

| Services | Moderate rise in employment | |

| Manufacturing | Employment rises at the fastest pace since May 2011 | |

| Input Prices | Composite | Input price inflation at 15-month high |

| Services | Faster increase in costs since September | |

| Manufacturing | Fourth consecutive monthly increase in input prices | |

| Output Prices | Composite | Charges increase for the first time since August 2015 |

| Services | Charges rise fractionally | |

| Manufacturing | Output prices rise at the fastest pace since June 2015 |

*Source: HIS/Markit

PMI’s point to a recovery in growth in Q4

The economic recovery in the euro area is expected to strengthen in the coming months according to the preliminary report. Data showed that faster growth was registered in the order books which are expected to accelerate the pace of hiring in the region as well. New orders grew at the fastest pace since January spurring an expansion in the labour market. The employment sub-index itself showed the biggest gain in nearly three months highlighting optimism in the coming months.

Chris Williamson, from Markit, said, “October’s PMI is consistent with a quarterly GDP growth of 0.4%, led by a 0.5% pace of expansion in Germany.”

Price pressures seen gaining momentum

The price of goods and services were also seen rising for the first time since August 2015. October’s flash report showed the extent of manufacturing supply chain delays hitting the highest level in five years prompting speculation that inflation could be increasing. Growth and rising price pressures add to speculation of robust Q4 growth prospects which could see the ECB hold back from extending its QE.

ECB December Meeting: QE extension or tapering?

At its meeting in October, the European Central Bank refrained from making any policy changes noting that QE was not discussed. However, Mario Draghi said that the central bank would take a decision in December. The euro fell steadily following the ECB’s meeting touching a 3-month low as the markets expect to see the central bank expand its QE beyond March 2017. But the downside comes at a risk if the preliminary data is anything to by. Positive growth and a return of the inflation uptrend could potentially kill the current hopes for a QE expansion.

“Policymakers will be encouraged by signs of both stronger economic growth and rising price pressures, and the prospect of a robust fourth quarter will fuel further speculation of a possible tapering of QE purchases by the ECB,” Williamson said.

The week ahead will provide an initial glimpse into the eurozone growth for the third quarter. Economists expect a headline GDP print of 0.3% for the quarter ending September, same pace as the previous quarter. However, given the flash PMI’s the prospects for an upside surprise cannot be ruled out. A bullish print on the GDP could reinforce further expectations that the euro area economic growth is likely to rebound during the reported quarter which could see further bullish bets increase in the single currency.