The pound made another visit to the 1.20 handle but managed to recover. The lows are not in yet, says the team at Citi:

Here is their view, courtesy of eFXnews:

The fundamentals arguably haven’t changed but the price has. This makes GBP look cheap – but we’re not certain the lows are in.

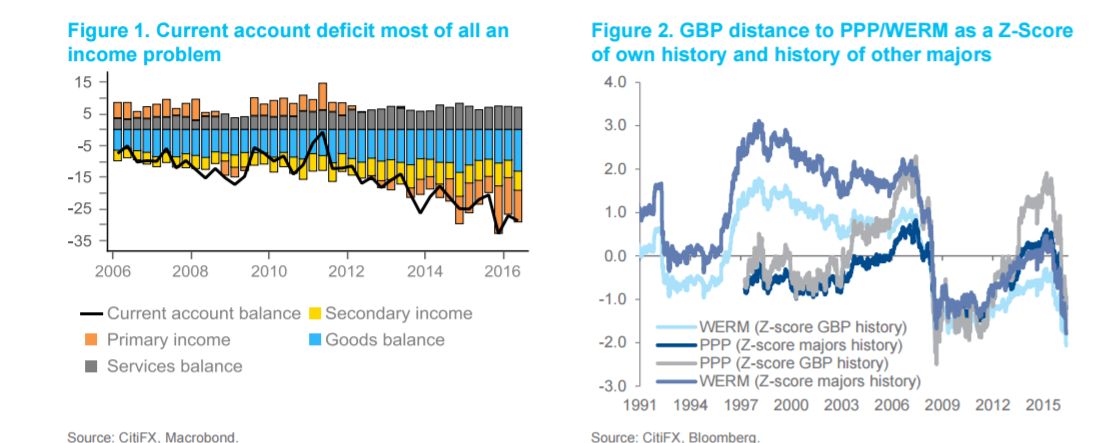

Updating our model from ‘GBP not objectively very cheap’, GBP is now trading more cheaply vs major currencies on WERM than it ever has been (Figure 2). On PPP there is still 5-10% to reach the ‘lows’.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The problem for the UK is that its need for foreign capital falls very little with a weaker currency. In fact, if yields on primary income didn’t change at all, extrapolating previous sensitivities, the CA deficit would widen on lower FX. The drag cannot be solved without a weaker economy – restraining imports and direct investment income outflows.

Domestic yields have retraced, increasing the primary income burden on the margin and at a higher level of fixed income volatility. Firming up the financial account by introducing more favorable policies for foreign direct investment and/or minimizing FX + bond volatility appear key to finding a GBP base.

Citi now targets GBPUSD at 1.15 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.