EUR/USD dipped its feet under 1.09 and remains under pressure. The team at ANZ sees further downside weakness.

Here is their view, courtesy of eFXnews:

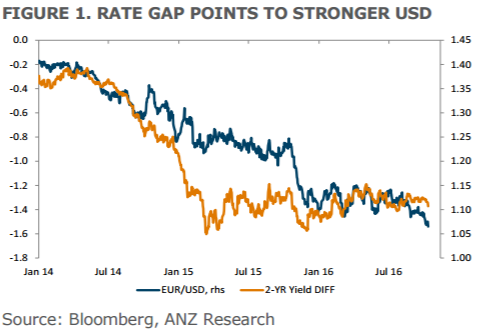

The prospect for divergent monetary policies returning to reassert themselves as a material influence on EUR/USD seems greater in the coming months than it has been this year.

As the US labour market tightens, the prospect of a recovery in business investment is rising as firms substitute capital for wages and as skill shortages intensify. As the oil price stabilises and the US rig count increases, the drag on investment from the oil price collapse should stabilise. Consumer confidence is at post-GFC highs and average earnings growth is gradually picking-up (September +2.6% y/y). Wealth effects could also be a source of significant support. In Q2 2016, US household net worth was USD89.1trn – up sharply from USD56.2trn at the end of 2008. The savings rate has normalised (5.7%) and while there are material issues with inequality, under a new President, middle class tax cuts should help support future consumption. This economic backdrop seems materially more upbeat than in Europe.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

There are elections planned in the Netherlands, France, and Germany, and if Italian PM Renzi fails in the 4 December referendum – which opinion polls suggest he will – there may be an election in Italy. The question of European integration given economic underperformance, immigration, Brexit, etc., all suggest some political risk premium for the euro and an overreliance on easy monetary policy for growth.

A lower EUR/USD looks probable – as does EUR underperformance against higher yielding APAC currencies.

Whilst forecasting direction in EUR/USD has been frustrating and fraught with many potholes over the past twelve months, the balance of fundamental risks seem to be stacking up in favour of USD strength in the coming months. We look for a move below 1.05 over the coming months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.