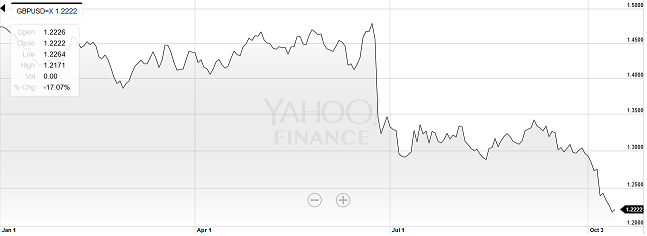

The sterling’s over 3.5% plunge a week ago, sending the exchange rate of sterling to 1.2179 a dollar on the back of the British PM announcing a Brexit timeline has rekindled focus on monetary policy in the United Kingdom.

After the initial knee-jerk reaction to the June 23 referendum results, the sterling enjoyed a momentary rebound with most of the forward looking economic surveys seen recovering. The data in the following months from July through September saw many revising the forecasts on the UK’s economic outlook with the common theme being that ‘Brexit was not as bad as it was made out to be.’

However, that narrative changed over the past two weeks after PM Theresa May announced that the UK would trigger Article 50 by as early as March 2017. The news sent the sterling plunging to record lows as GBPUSD was seen resuming its ‘Brexit downtrend.’

GBPUSD – year to date, 2016

UK inflation set to rise rapidly

The Great British pound is now down by over 8% since early September and adds additional upside risk to inflation. The Bank of England, in its last monetary policy communiqué, noted that it would assess the economy and take a decision on interest rates at the next meeting in November.

Given the current scenario and the renewed slump in the British pound, the BoE could be seen holding off from further rate cuts. While it could take as much as quarter or two, to assess how much of impact the currency depreciation has brought about, the current state of affairs reminds one of the similar crisis that was managed by the Bank of England in 2011.

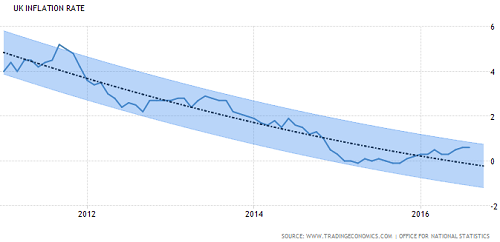

Coming off the 2008 global financial crisis, the British pound posted a strong decline towards mid-2016. This led to an increase in consumer prices which were also boosted by strong oil prices as well sending UK’s inflation rate to 5%. The central bank, under the guidance of the then governor Sir Mervyn King saw the threat of recession taking priority over inflation. This eventually led to the Bank of England announcing QE measures as a result.

Comparing the conditions then and now, the BoE could be forced to revisit its monetary policy stimulus program while staying reluctant to touch the interest rate lever. The next central bank meeting is on November 3rd.

On Friday, October 14, BoE Governor Mark Carney said that the central bank was not indifferent to the sterling’s exchange rate, which helped the currency to pare some losses modestly. As expected, Carney said that the bank would tolerate slightly higher inflation than its target. “Our job is not to target the exchange rate; our job is to target inflation. But that doesn’t mean we’re indifferent to the level of sterling. It does matter, ultimately, (for) inflation and over the course of two to three years out, so it matters to the conduct of monetary policy,” Carney said on Friday at an event in Nottingham.

UK Inflation Rate

Data Watch: Inflation, Jobs, and Retail Sales

The week ahead will see inflation numbers and monthly unemployment figures from the UK. Forecasts point to a 0.90% increase in headline CPI on a year over year basis, accelerating from the 0.60% inflation recorded in August. PPI is also expected to gain in September with PPI input seen rising 0.40% while PPI output is expected to rise by a modest 0.20%. The longer run inflation expectations could, however, start to rise rapidly especially if the exchange rate continues to remain anchored below the $1.1240 price level.

On the jobs front, forecasts point to a stable month of September with headline average earnings index expected to rise 2.30% while the unemployment rate is expected to stay put at 4.90%. The pace of earnings has somewhat slowed following the months after the Brexit vote and any further deterioration in earnings could keep the GBP well pressured to the downside.

Retail sales figures will be out on Thursday with expectations showing a 0.30% increase in September, which follows a 0.20% decline in August. Retail sales could be seen picking up in the months ahead as seen by the surge in retail sales following the strong decline in the GBP in June.