The pound continued suffering after the big flash crash and there may be more in store. And for longer. Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

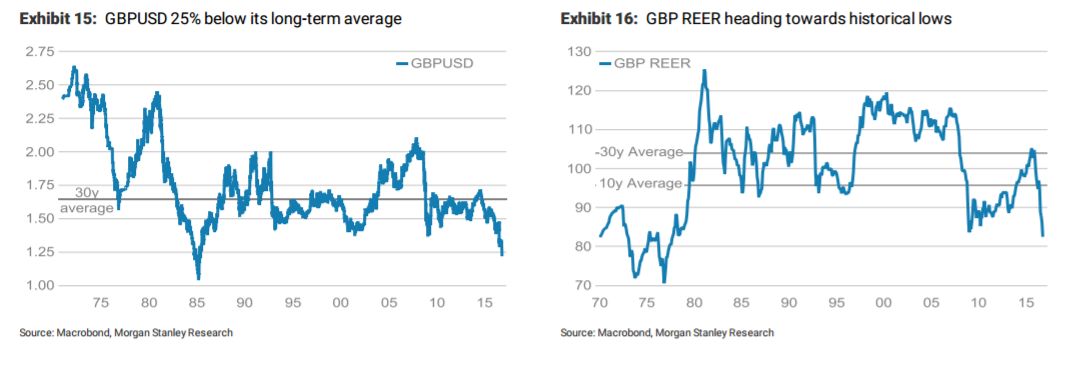

Bottom Line: We are changing our forecasts to expect more GBPUSD weakness in coming quarters and little recovery next year. The higher probability of a “-Brexit” and uncertainty for businesses should drive reduced investment into the UK, particularly from foreign investors. Less investment should push GBP weaker through a lower economic growth trajectory. GBP short positioning isn’t yet extreme, it can go even lower, in our view.

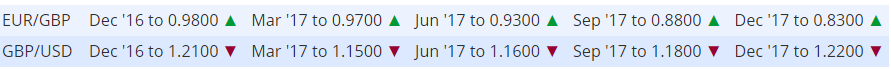

On GBPUSD we target 1.21 for the end of this year and see a low of 1.15 in 1Q17 before a recovery back to 1.22 by 4Q17.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The GBP bull case. Where could we be wrong on this bearish GBP projection?

First, the government may soften its stance,allowing the Parliament to vote on Brexit negotiations, which could then put EU market access back as the main priority of upcoming negotiations with the EU. In this case, GBP may turn back to levels traded in July/August, i.e., rally 10% from here.

Secondly, the government may introduce private/public partnership funding infrastructure projects leading to better economic activity and inflows. Should such an approach follow at the same time the government moves towards a softer Brexit stance, GBPUSD may even move up into upper 1.30s handle.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.