EUR/USD was shaken by the pound flash crash but remained in range. The team at JP Morgan analyzes the numbers:

Here is their view, courtesy of eFXnews:

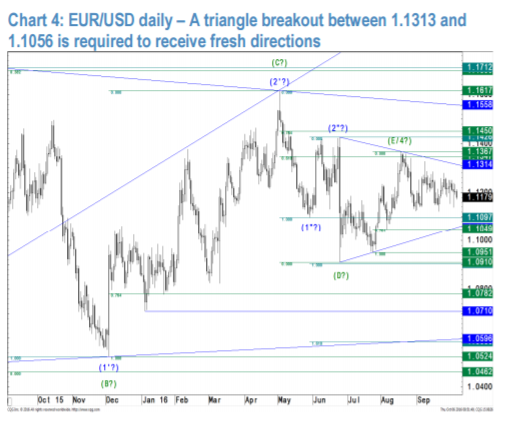

EUR/USD failure to stabilize above a projected E-wave target at 1.1347 (int. 61.8 %) seven weeks ago leaves EUR/USD at great risk of having completed a 1 ½ year old consolidation triangle with very negative implications.

Only a break above 1.1367 (August high) and ultimately above 1.1426/50 (pivot/int. 76.4 %) would constitute a game change in favor of a re-test of former highs at 1.1617 and at 1.1712 with the option to extend to the classical wave IV target on big scale at 1.1811 (int. 38.2 % on highest scale).

So considering the classical overshooting at 76.4 % retracements it would most likely take a break above the 1.1500 handle to eliminate the imminent sell-off risk. It would take breaks above 1.1876 and 1.2042 (2010 & 2012 lows) though to call for a long-term trend reversal.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

In the short.-run we are now watching the daily triangle between 1.1313 and 1.1056 closely as a breakout would provide an early indication whether we are dealing with a stronger recovery or with the potential resumption of the downtrend.

A decisive hourly close above 1.1347 (i.e. above 1.1370) would thereafter bring 1.1426/50 (pivot/int. 76.4 %) and possibly former highs at 1.1617 and 1.1712 back into focus whereas breaks below 1.1056/49 (daily triangle/minor 76.4 %) would challenge the essential countertrend decline target zone between 1.0782 and 1.0710 (int. 76.4 % on higher scale/pivot).

It would take a break below the latter though to confirm the resumption of the long-term downtrend in favor of an extension to 1.0072 (76.4 % of the 2000-2008 rally) and to wave 3 projections between 0.9652 and 0.9298.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.