The Australian dollar had a positive quarter, making the biggest gain against the greenback among its peers. More gains could follow, at least in the short-term, says the team at Morgan Stanley.

Here is their view, courtesy of eFXnews:

AUD to receive short-term lift. To be clear, this is not because we are bullish on the medium-term outlook; Australia has done little to improve its medium-term inflation outlook, the housing market remains a key downside risk for 2017,valuation is relatively rich and external accounts make it vulnerable.

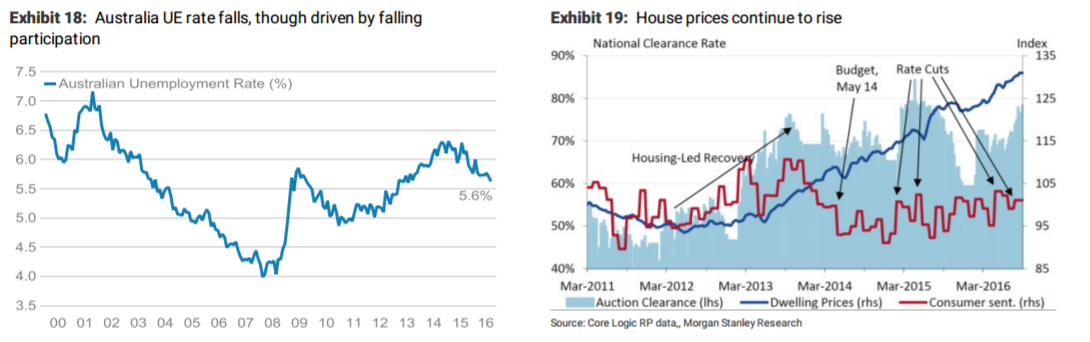

However, we would say that everything in Australia is ‘good enough’ to keep the currency appreciating and keep the RBA on the sidelines amid the global search for yield. YoY GDP growth in 2Q hit its highest level since 2012(with mixed quality), the unemployment rate continues to fall (though other employment metrics are weak), and China’s stability has kept iron ore prices stable. House prices have failed to meaningfully decelerate, though forward-looking indicators look more worrisome, raising concerns about financial stability which the RBA emphasized in the most recent agreement on its monetary policy framework.

All in though, these developments are not enough to push the RBA to act this year and are enough to keep AUD appreciating in the search for yield environment.

While the RBA certainly wants a lower AUDUSD, the failure of the last rate cut to weaken AUD is likely to make it think twice about using the policy rate as a tool for FX depreciation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.