The US dollar is looking for a new direction after the Fed left rates unchanged but hinted for a hike, and as uncertainty prevails after the first presidential debate. The team at Morgan Stanley sees downside risk for the greenback:

Here is their view, courtesy of eFXnews:

Flatter curve, weaker USD. We project the USD to fall another 3-4% from current levels, with the US economy slowing into Q4 working as the catalyst. The rates market is pricing around a 50% probability of the Fed hiking by year end, but with growth expected to dip in Q4, headwinds for the Fed to act are likely to become stronger. We believe weaker US data should not only reprice US front end rates but also flatten the US curve further from here, taking the USD lower.

Liquidity hunting yield. Liquidity conditions remain ample, with Japan’s latest flow of funds report suggesting its corporate sector cash position increasing to USD2.2trn. Hence, demand for safe assets remains plentiful, pushing valuation for these assets to high if not extreme levels. Exhibit 1 shows that DM yields have fallen in recent weeks, increasing the amount of negative-yielding bonds to around USD11trn. Investors seem to have little choice other than piling into yield-enhancing strategies, suggesting accepting high risks about returns. However, it is not only the hunt for yield that is putting the USD under selling pressure. Rising USD funding costs coming on the back of rising US LIBOR rates have reduced international demand for USD-denominated debt. Despite foreign accounts slowing their purchases of US bonds, US bond yields have come down, which for us provides additional evidence that the US economy is slowing down.

The message of falling DM yields. When bond yields are falling at the same time as foreign purchases ease, it suggests that the internal supply-demand balance for US capital market is shifting toward the demand side. This, in turn, suggests that the slowing US economy is creating net additional savings, causing its capital costs to fall. The remaining yield is no longer high enough to attract the same amount of unhedged FX inflows. Instead, these funds go elsewhere looking for higher yield, but this return comes at greater risk too.

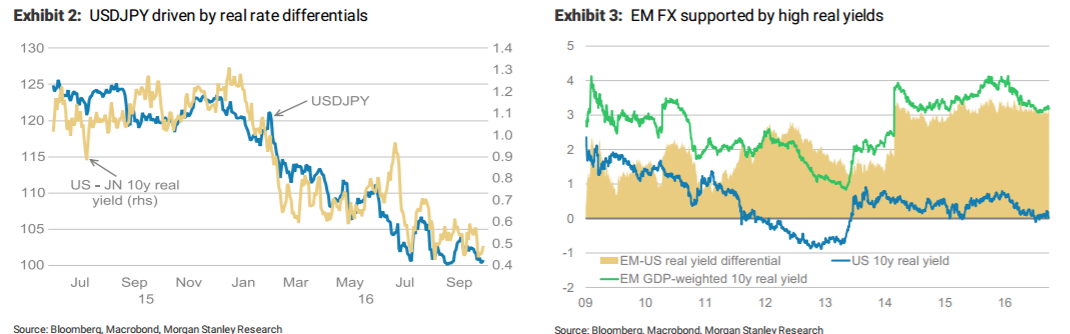

USD: Two pressures. So far, we have argued from a real rate and yield differential point of view. Exhibit 2 reminds us how real yield differentials have driven USDJPY lower, which is typical for currencies experiencing near zero nominal returns and inflation projections falling faster. Exhibit 3 illustrates the US – EM real yield differential working in favour of the higher-yielding EM currencies. It seems that the current low-yielding environment promotes two types of currency appreciation. First, where nominal yields have limited room to fall further, declining inflation expectations drive real yields higher, pushing related currency higher. Second, high-yielding currencies appreciate with low volatility, allowing investors to increasing exposure without violating VAR rules. The USD stands in between these two currency blocks acting as a funding tool.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.