EUR/USD is grinding higher but still struggles for a new direction. The team at JP Morgan describes the battle between the bulls on the bears:

Here is their view, courtesy of eFXnews:

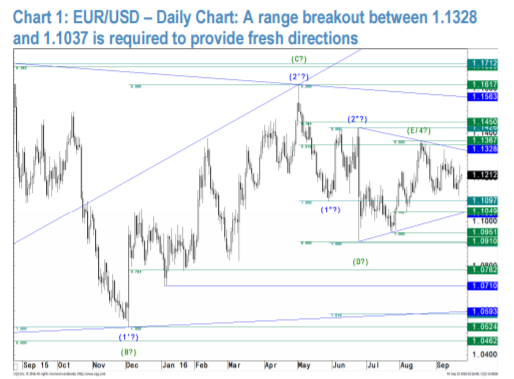

Since EUR/USD bottomed at 1.0462 in March 2015 it formed a broad consolidation triangle (A-B-C-D-E, green) which could be complete as the market stalled right around its projected E-wave target at 1.1347 (int. 61.8 %) five weeks ago.

Following this view, any bounce should now be capped at 1.1309/28 (minor 76.4 %/daily triangle).

Only a break above the latter would re-open the upside for an extension to the next higher T-junction at 1.1426/50 (pivot/int. 76.4 % on higher scale).

Below 1.1309/28 though, we see a negative bias prevailing and the market at risk of at least testing key-support at 1.1049/37 (int. 76.4 %/daily trend).

A break below the latter would finally challenge the key-T-zone on big scale at 1.0782/10 (int. 76.4 %/pivot).

A break below the latter would resume the long-term downtrend in favor of an extension to 1.0072 and possibly to 0.9652 and 0.9298 (wave 3 projections).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.