In the immediate aftermath of Hilary Clinton’s resounding success during the first Presidential debate this week, the New Yorker ran a hilarious satirical post claiming that Trump would boycott any future debates in which his rival was also allowed to participate. This encapsulates the ego-centric nature of Trump’s campaign so far, in which brashness and an overwhelming sense of arrogance have superseded substance.

The recent debate also threw a spotlight on the financial markets, and more specifically how they would react to a Clinton or Trump victory. Analysis of the Forex market was particularly in-depth, thanks largely to its volatile nature and vulnerability at the hands of economic and political trends. The results were scarcely surprising, especially given the nature of the two candidates and their anticipated Presidential styles.

Why the US Dollar Would Rise in the Event of a Trump Win

In simple terms, the US Dollar would most likely soar in the event of a Trump win, at least if the indicators from the recent debate are anything to go by. While Clinton’s poised and polished performance ruffled her rival and sent the notoriously risk-averse stock market soaring, for example, the value of the Dollar tumbled as the debate unfolded and this offers a clear insight into the how the foreign exchange would look in the wake of a Republican success.

Naturally, the Mexican Peso soared as Clinton gained the initiative, thanks largely to Trump’s regressive foreign policy and reported views on immigration.

Now while such trends are not set in stone and could yet change, this result appears to be a clear sign of faith in a potential Clinton government. With an independent poll by CNN suggesting that 62% of viewers believed that Clinton won the first debate convincingly, there was a significant rise in investor sentiment. This was reflected by the decline of the US dollar, which remains the world’s most popular safe-haven asset during times of austerity or volatility.

So with Clinton’s performance inspiring obvious investor confidence, the level of demand for the dollar shrunk considerably as a result.

The Bottom Line

Ultimately, the value of the dollar is likely to increase in the short-term regardless of who wins the Presidential election. Once the initial period of uncertainty is over, however, all signs point a lower dollar rate if is Clinton is elected (and a higher premium if Trump’s campaign builds on its pre-debate momentum and carries the day). Additionally, the high degree of correlation between the performance of dollar and the prevailing level of risk aversion means that a Clinton victory would increase the appetite for risk among investors increase while allowing emerging markets (such as Mexico) to profit as a result.

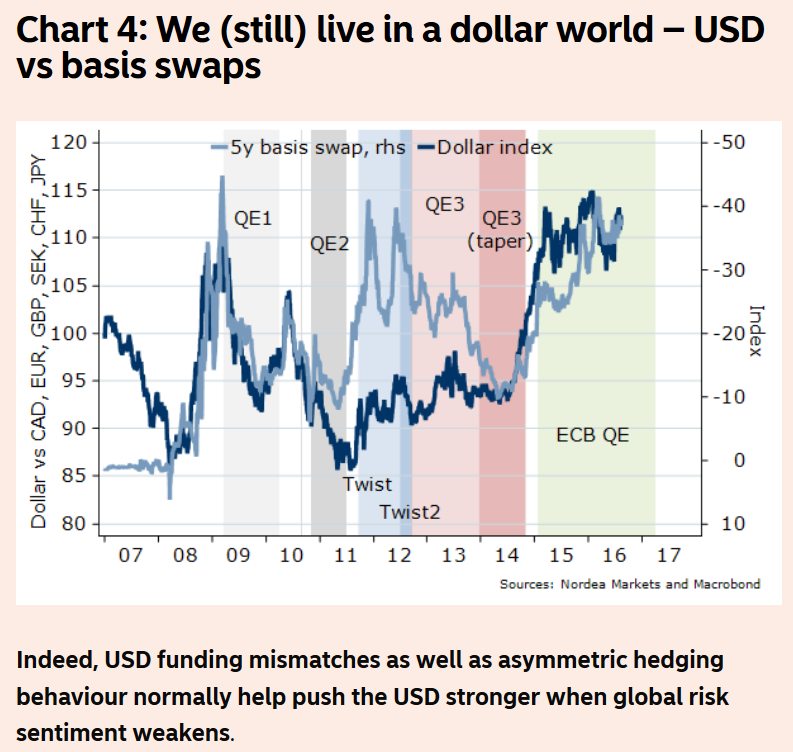

Sources: Nordea Markets and Macrobond

While this is far from idle speculation, particularly given the underlying laws that govern macroeconomics and the impact of politics on various economic and financial triggers, we only know two things for certain right now. The first is that Hilary Clinton has stolen a march in the election campaign, and can cement this with similar performances in the next two debates. Secondly, a Clinton government would most likely trigger a burst of investor confidence and boost the stock markets, while lowering risk aversion and the value of the US Dollar accordingly.

This is a guest post by Marcus Turner Jones of Oanda UK, which is an online broker site dedicated to forex trading.