There are low chances that the Fed pulls the trigger in September, but December is certainly on the cards. Which currency could bear the brunt? The team at CIBC circles the kiwi and explains:

Here is their view, courtesy of eFXnews:

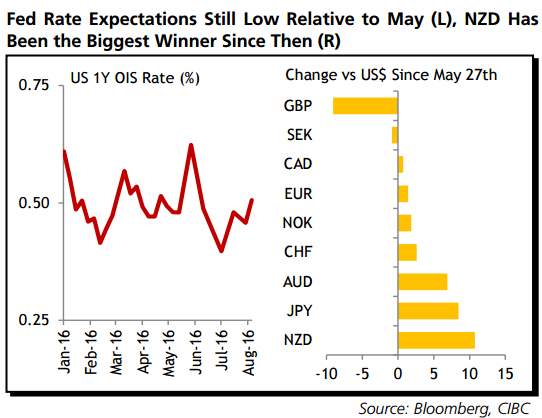

Through the will-they-or-won’t they of Fed rate hike expectations one thing is clear – much less is currently priced into markets than was the case in late May. Since then the US$ has been generally lower, with the clear exception of course been against a Brexit-hit GBP. Interestingly, it’s been the NZD, and not JPY that’s gained the most since Fed hike expectations were at their peak.

High interest rates, at least relative to those available in most major economies, have made New Zealand a magnet for investors.

However, with Fed expectations now getting too low again, the NZD could be more vulnerable than others in the run up to the next FOMC move.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.