The European Central Bank convenes in September 2016, the original date that QE was supposed to end. It has already been extended to March 2017. Will they already push back the end date now? Or take other measures? Here are two opposing opinions:

Here is their view, courtesy of eFXnews:

ECB Preview: QE Extension On Thursday; Another Depo Cut In December – RBS

We do not expect any changes to interest rate settings or to the monthly pace or the scope of the asset purchase programme (APP) at this Thursday’s meeting. But we are now expecting the ECB to extend the APP from March 2017 to September 2017

We think the ECB would rather act on this timing issue now rather than delay what we believe to be an inevitable adjustment to the programme at a later date. Mr Draghi has been emphasising that global and domestic growth risks remain tilted to the downside. He will be mindful too that inflation expectations are still not that far off record lows despite a higher oil price and the package of easing measures that were launched earlier this year.

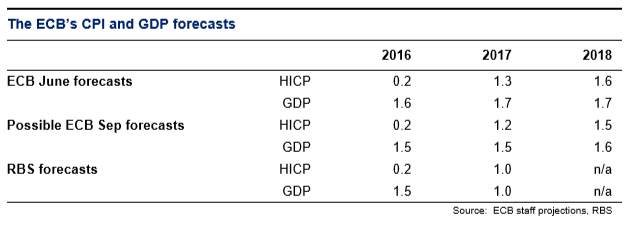

Downward revisions to the Staff Projections are likely. On the ECB’s staff forecasts we have provided some indicative numbers below on the possible revisions that will emerge this week. Overall, we do not expect major changes vs. the June projections, particularly on the inflation front. However, given recent disappointing CPI data and, specifically, still-subdued core pressures, we expect the 2017 and 2018 projections to be trimmed by 0.1ppt. On the growth front, some modest Brexit-induced downward revisions are likely. Specifically we expect the projected GDP growth rates to be cut by 0.2ppt in 2017 and 0.1ppt in 2018. Relative to our expectations for the Staff Projections (and consensus expectations, according to Bloomberg), we maintain our view that the incoming data will disappoint in the months ahead.

The bigger picture is that global growth appears to be slowing and appears highly susceptible to a number of negative shocks. The underlying imbalances that have bedevilled the European outlook in the meantime have not yet been resolved and seem unlikely to be against a backdrop of political instability. And partly because of those political issues the appetite for fiscal policy stimulus in those economies that have the space to use it remains extremely weak. In short we find it very hard to imagine – notwithstanding technical complications – that the ECB has finally delivered the necessary dose of monetary stimulus to meet its inflation mandate in the months ahead. As a result we expect another cut in the depo rate and a further upscaling of the QE programme in December.

ECB Will Keep The Powder Dry: No QE Extension At September Meeting – Danske

We have changed our view and now expect the ECB to remain on hold at the meeting in September. We believe that in the ECB’s view the incoming information since July does not warrant additional easing.

We still firmly believe the ECB will eventually extend QE purchases beyond March 2017 due to the lack of a sustainable path in inflation. However, for now, we expect it to keep its powder dry. A QE extension could be accompanied by changes to the purchase restrictions but we do not expect this to be announced in September.

Previously, we also expected a temporary step-up in QE purchases as we looked for a weakening in economic data. However, due to the surprisingly resilient economic sentiment despite the UK’s decision to leave the EU, we find it likely that the ECB will maintain the current pace of monthly purchases at EUR80bn.

In terms of rate cuts, we stick to our view that the ECB will not cut rates further. Back in March, the ECB stepped out of the currency war and instead focused on the bank lending channel, which is crucial in the transmission of monetary policy in the euro area.

Notably, the ECB argued in its minutes from the July meeting, that ‘additional demand could be expected for the forthcoming TLTRO II operations’. This supports our view that the ECB will be in wait-and-see mode until after the second TLTRO II auction (the allotment results are due to be published on 22 September).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.