Last week saw another solid report from the UK as the manufacturing PMI data emerging on the top. From July’s 85-month low of 48.3 (revised from 48.2), UK’s manufacturing PMI soared to a 10-month high in August to 53.3. The survey from Markit led David Nobel, CEO of CIPS claiming “Brexit breaks are off.” A day later, UK’s construction PMI failed to live up to the high standard set by the manufacturing sector. Still, construction PMI was seen recovering, rising from July’s 46.6 to 49.2 in August.

PMI’s point to inflationary pressures

The PMI numbers are important as they are a leading indicator and therefore forward-looking and reflect sentiment in businesses. Looking at both the manufacturing and construction PMI, the common factor has been the rise in the cost of input prices. Although most of the recovery in both the sectors came on a weaker exchange rate, it is the same reason that has put pressure on input prices. This indicates that an increase in inflation is just around the corner.

The latest data also makes one question whether the Bank of England moved too early to cut interest rates and expand its QE. A sticking point that has often come up since the BoE loosened monetary policy in August. Still, the BoE’s policy actions following Brexit can be seen as cushioning the effects to a certain extent.

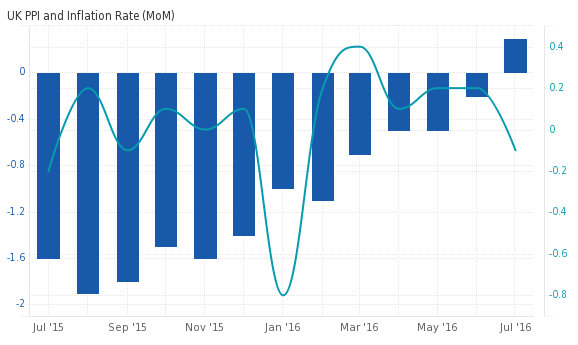

At the most recent inflation report, data showed that the headline CPI increased 0.60% on a year over year basis in July, while core CPI grew at a slower pace of 1.30%, down from 1.40% in June. The report also confirmed the view that input prices were rising. In July, PPI input increased 3.30% on a month over month basis.

UK PPI and Inflation Rate (MoM) – July 2016

UK PPI and Inflation Rate (MoM) – July 2016

With the Bank of England already caught near the lower bound, further inflationary pressures could see the BoE stand pat on policy at least until December in order to assess the economic data for a full quarter after June’s Brexit outcome.

BoE Inflation Report Hearings this week

Although a relatively quiet week for the UK Monday’s services PMI will be the first event to watch out for. With the services sector usually seen as the strongest, it would not be surprising to see a strong recovery in the services PMI as well. The services PMI have been stuck at 47.4 for the past two months of June and July. The July’s PMI report, however, contained similar undertones of the weaker exchange rate aiding new export order growth and marked a second consecutive month of increase.

Wednesday promises to be a busy day for the sterling as UK’s industrial and manufacturing production is expected to show a decline of 0.30% and 0.40% respectively. Later in the day, the Bank of England’s inflation report hearings will see Governor Carney testify to the UK parliament. Watch for any hints on rising inflationary pressures which could give some validation to the forward looking PMI surveys.