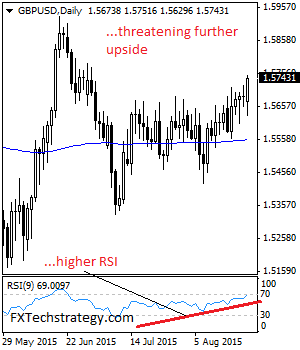

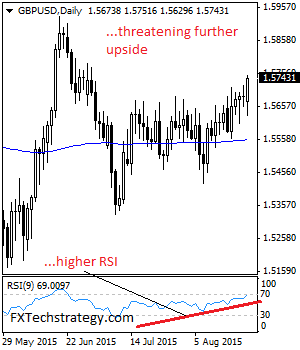

GBPUSD: GBP continues to face upside pressure following its corrective recovery bullish offensive. With the pair trading above its cluster of resistance at the 1.5689/77 zone, more strength is envisaged. Further out, resistance resides at the 1.5800 level followed by the 1.5800 level.

A turn above here will open the door for a run at the 15850 level. Its weekly RSI is bullish and pointing higher supporting this view. On the downside, support lies at the 1.5600 level where a break if seen will aim at the 1.5550 level. A break of here will turn attention to the 1.5500 level. Further down, support lies at the 1.5450 level. On the whole, GBP faces the risk of a recovery higher on correction.

The pair has alternated between weekly gains and losses over the past two months. With uncertainty continuing over the Fed rate hike continuing, we could see the pair in a holding pattern.

In our latest podcast we collect the crashes: commodities, Fed hike and later Greece

Follow us on Stitcher.