- Yellen’s speech as Jackson Hole sparks dollar buying

- August payrolls report could either be the catalyst to shape expectations for September rate hike

- FOMC and BoJ are the two main central bank meetings to watch this September

- ECB could most likely remain on the sidelines

- USDJPY could see strong moves into the two main policy events

After a relatively tight range of trading, the summer spell was broken last week at the Jackson Hole symposium. With Yellen indicating that the Fed was close to meeting its targets, and supported by hawkish views from other FOMC members, the markets managed to break out from the slumber with the US dollar saw posting steady ground since the August 25 – 26 event concluded.

Despite the hawkish narrative from the Fed, it is still unclear on the timing of the next rate hike. Among the many speeches given, it was only the vice-chair, Stanley Fischer who gave some form of indication. When asked in an interview on CNBC if rates could be hiked as early as September, Fischer replied, “I think what [Yellen] said today was consistent with answering yes to both your questions, but these are not things we know until we see the data.”

August Payrolls Report will be a game changer

With the stage set for a showdown in September, the big question on investor’s minds is whether the Fed will indeed follow through. The answer to this question was partly answered earlier this week as July’s core PCE data showed no disappointments. Still, investors are not very sure that the Fed will move the Fed funds rate higher. The last piece to this puzzle could perhaps come from this Friday’s payroll’s report.

On Thursday, private payrolls were seen adding 177k jobs in August, slightly higher than estimates, but lower than the revised number of 194k from July.

With August private payrolls coming out optimistic, investor focus will shift to the BLS’ report where economists expect to see around 186k jobs being created while the unemployment rate is expected to fall to 4.80% from 4.90%. The average hourly earnings meanwhile are expected to ease to 2.50% on a year over year basis, slightly lower than 2.60% increase seen in July.

Omer Esiner, chief market analyst at Commonwealth Foreign Exchange, says, “[A strong jobs report on Friday] could tip the scales in favor of a possible rise in borrowing costs as early as next month. Such a scenario would likely send the dollar broadly higher as investors currently see only a very slight chance of a September rate hike.”

The CME Futures FedFunds Watch still gives a less than 50% probability of September’s FOMC meeting a 25bps rate hike; but this could change (in either direction) come Friday, September 2nd, 2016.

Central Bank policy actions to watch: Bank of Japan

Although the euro also took a beating over the past week, the ECB’s meeting next week on September 8th is quite likely to pass off as a non-event; at least as far as QE expansion is concerned. The ECB’s staff economic projections could add some short term noise, but the ECB is certainly not in a hurry, which puts investor attention to the Bank of Japan’s meeting.

The BoJ’s policy meeting is due on September 20th, just a day before the FOMC meeting. With most of this year seeing investors being constantly disappointed, the September meeting could see the BoJ finally expanding its QE purchases.

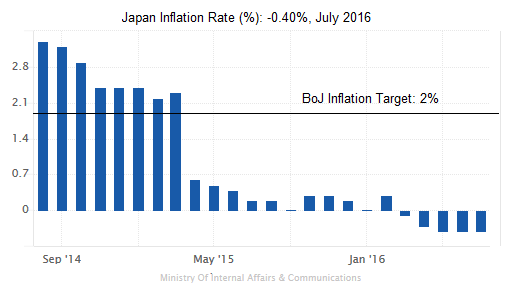

In July, the Bank of Japan said that it would conduct a comprehensive review of its policies and the text of the speech by Kuroda at the Jackson Hole event showed the policy maker saying that there was “no doubt that ample space for additional easing in each of these three dimensions (quantity, quality, and the interest rate) is available to the BOJ.” With latest inflation figures showing no signs of pressure, the markets could once again set up for a showdown with the BoJ, which could bring significant volatility as both the US dollar and the Japanese yen head into a 24 hour highly volatile period.

Japan Inflation Rate, July 2016: -0.40%

Japan Inflation Rate, July 2016: -0.40%

Is it time to buy USDJPY?

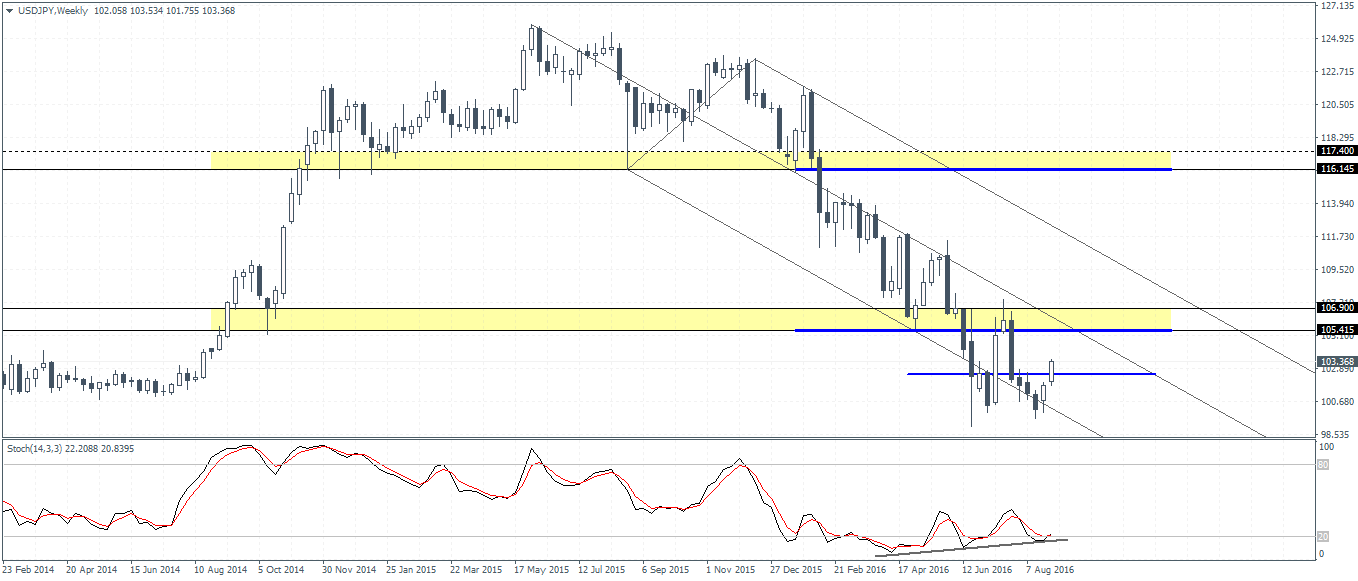

From a technical outlook, the weekly chart for USDJPY paints a better picture of the long term trends. While prices are seen stabilizing near 100.00 – 100.50 level, there are still no signs that USDJPY could be turning the corner. Watch for the technical resistance near 106.90 – 105.41 and more importantly, watch for a higher low in USDJPY on the weekly time frame.

USDJPY (103.36) – Weekly Chart showing bullish divergence